February 11, 2026

Buying a house? Beware of seller impersonation fraud.

One of the fastest-growing real estate scams targets vacant or unoccupied houses for sale.

It starts with someone forging documents to sell a house they don’t own. They list a house below market value and accept a quick offer – with a preference towards cash buyers – to steal the money from the sale.

Put your guard up if a seller:

- Tells your agent they only want a cash buyer.

- Doesn’t show up for closing or asks to sign documents electronically.

- Asks for a remote notary at signing and wants to use their own notary.

- Asks that the money from the sale go directly to them.

Some tips:

- Visit the house you want in person. Only the real homeowner can give your agent the key.

- Ask your agent to use a trusted in-person notary at closing.

- Buy title insurance. Your real estate agent will likely recommend it and your mortgage company will probably require it. Title insurance protects you from problems with an ownership title.

Report fraud to the Texas Attorney General, the Federal Trade Commission, and your local police.

Learn more

- What is title insurance? Why do I need it for my new house?

- Red Flags and Best Practices (PDF) from the Texas Land Title Association

- FAQ: Title insurance

January 29, 2026

Unexpected indoor waterfall? Home or renters insurance might help.

A pipe bursts—or a toilet overflows or a washer hose breaks.

Good news: Your home or renters insurance policy covers sudden and accidental water damage. Your personal belongings are covered too.

Also, if mold develops on a damaged item, it would be covered.

Still, policies usually won’t cover damage from gradual leaks or seepage—and that includes damage from mold.

Mold from a flood wouldn’t be covered because home policies don’t cover floods. You would need a separate flood policy.

If you have a sudden leak, shut your water off at the main. Move expensive items off the floor. Your insurer may deny your claim if you don’t protect your property.

One more tip: You can always check what’s covered by reading your policy or calling your agent.

Listen to this Texas Insurance Podcast to hear expert advice on insurance and water damage.

Learn more

- When are water damage and mold covered by insurance?

- Winter storms: Tips for preparing your house and pipes

January 26, 2026

A home warranty is not home insurance

When buying a home, you might be asked if you want a home warranty or residential service contract. A home warranty is different than home insurance.

- Insurance pays for damages from events your policy covers like fire or theft but not wear and tear.

- Warranties cover certain items in your home when they break down from normal wear and tear. Depending on your warranty, you may get coverage for appliances, such as stoves and refrigerators, water heaters, electrical and plumbing systems, and even swimming pools.

Home warranties can bring peace of mind about the equipment and systems that keep your home comfortable but carefully read the fine print before signing up. Not all home warranties are the same.

Under Texas law, companies that sell home warranties must be licensed by the Texas Department of Licensing and Regulation (TDLR).

Learn more

- List of TDLR-licensed residential service companies

- Residential service contract (video)

- Five things your home policy won’t cover

January 24, 2026

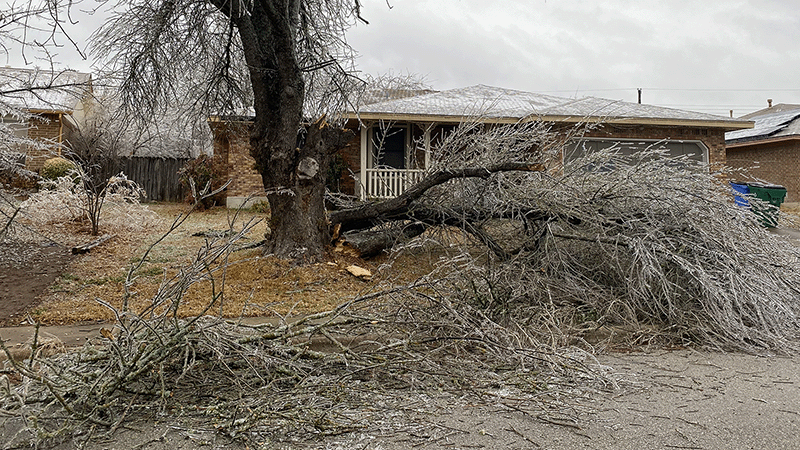

Does insurance cover fallen tree branches?

Will insurance pay when a tree crashes down on your car or house?

Sometimes.

If a tree or branch falls on your house or car, use these tips:

- Take photos of the damage before you move the tree, make repairs, or take other steps to prevent more damage.

- Make temporary repairs to prevent more damage, and contact your agent or insurance company as soon as possible.

- Save your receipts for reimbursement. Your homeowner policy should cover materials and labor used to make repairs.

FAQ about trees that fell in your yard

A tree fell on my house and damaged my roof. Will my homeowners pay for repairs?

Many policies pay for damages from falling objects, like trees. Call your agent or company to ask if your policy will pay.

A tree fell in my yard. Will my homeowners policy pay for tree removal?

Many policies provide some coverage to remove trees or limbs that fell due to storm damage and damage your house or block your driveway. Trees and limbs falling in your yard usually aren’t covered. Call your agent or company to ask if your policy will pay.

My neighbor's tree fell on my house. Will my neighbor´s homeowners policy pay for the damage and tree removal?

Probably not, unless your neighbor was at fault. Your neighbor isn’t responsible for acts of nature. If your neighbor's policy doesn’t pay, you can file a claim under your own policy.

A tree fell on my car. Will my auto insurance pay for the damage to my car?

Your auto policy will pay for damages if you have comprehensive coverage.

If the tree was your neighbor’s, their homeowners insurance might pay if your neighbor is somehow at fault. If not, their policy likely won’t pay because your neighbor isn’t responsible for an act of nature.

Other questions? Call our Help Line at 800-252-3439.

Learn more

January 23, 2026

Avoid frozen pipes and costly water damage by taking steps now

Freezing temperatures can cause frozen pipes.

But by taking simple steps now, you could head off thousands of dollars of water damage to your walls, ceilings, carpets, and furniture.

Key tips

- Install inexpensive wraps on exposed pipes. Start in the attic, where many Texas homeowners saw pipes freeze last winter.

- Wrap your outdoor faucets.

- Whether you own your home or live in an apartment or condo, identify water shutoff valves indoors and out. This will ready you for cutting off the water if a freeze poses risks.

- Don’t delay preparations until a freeze looms. Act now to ease your worries.

In this TDI video, How to prevent pipes from freezing, an expert with the Texas State Board of Plumbing Examiners shows several preventive steps you can take (plus, he spots a toad).

Learn more

- How to prepare your home for a winter storm (video)

- When are water damage and mold covered by insurance?

January 22, 2026

Auto and home insurance rate changes

Your premiums for auto and home insurance are likely different every year. This shows how much insurance companies have changed their rates on average across the state.

Private passenger auto average rate change

Source: TDI rate filing data

Homeowners average rate change

Source: TDI rate filing data

Note: includes rate changes for owner-occupied homeowners, tenants, condos, and mobile homeowners policies.

What’s the difference between a premium and a rate?

Premium – The amount you pay to an insurance company for an insurance policy.

Rate – The cost of insurance per exposure unit ($1,000 of home coverage or one year of auto coverage).

Example – A gallon of gas costs $3.50. I pay $49 to fill up my car’s 14-gallon gas tank. The premium is $49. It’s the rate ($3.50) times the unit (14 gallons).

Learn more

How are your auto and homeowners insurance costs calculated?

January 8, 2026

Home insurance might cover dog bite costs

A dog bite bites—with about one in five dog bites requiring medical attention.

If your dog bites someone on your property, your homeowners insurance might help.

Tips:

- Some policies exclude certain breeds. To be sure, check your policy or call your insurance company.

- Medical payments coverage in your policy pays the medical bills of people hurt on your property. It also pays for some injuries that happen away from home, like at a park.

- You might want to buy more liability coverage through an umbrella policy. A personal liability umbrella policy helps if your home insurance doesn’t cover dog bite injuries or doesn’t pay enough. Umbrella coverage pays up to a certain amount (usually $1 million or more) for medical bills, lost wages, and lawsuits if someone sues you.

Learn more

December 5, 2025

Prepare your home before winter’s fury hits

Winter’s cold can freeze and burst your home’s pipes, causing costly misery.

But you can prepare before the temperature falls.

Before a freeze:

- Wrap outdoor and indoor pipes in unheated areas (like a clothes washer in your garage).

- Remove water hoses and wrap outdoor pipes.

- Drain and turn off your lawn sprinkler system.

Inside, open cabinets under sinks to let your home’s heat warm the pipes. Let faucets drip from the cold and hot taps or run water through your indoor faucets – hot and cold – before you go to sleep.

If your pipes freeze, turn off the water at the shutoff valve. This prevents broken pipes from leaking into your house after they thaw.

Learn about prepping your home and car for winter’s cold in TDI's Texas Insurance Podcast.

Learn more

- Winter storms: Tips for preparing your house and pipes

- How to prevent pipes from freezing (video)

- How to make your house winter-ready

December 1, 2025

Ask these questions before you buy and insure your home

Owning and insuring a home is a big deal. You’ll want to ask questions before you buy.

Here are a few questions that could affect how much you pay for home insurance:

- How far away are emergency services like the fire department? Is it a paid fire station or a volunteer fire department?

- Is the home in an area that has flooded in the past? Flood damage is not covered by most home insurance. You’ll need a separate flood policy to cover rising water.

- Have there been past insurance claims on this home? Ask the owner for a CLUE report; it shows claims filed for a property over recent years.

- Check if the home has features that could reduce the risk of future claims. Is the roof new? Does the home have an alarm system or fire sprinklers? Such safety features could qualify you for an insurance discount.

Learn more

- How much homeowners insurance do you need? (video)

- Home insurance guide

- FAQ: Homeowners insurance, claims, saving money, and more

- Tips to help you shop for homeowners insurance

- How to get a CLUE about your claims history

- Home policies: Replacement cost or actual cash value?

October 22, 2025

Do you know the difference between insurance company and insurance group?

When you look at your home or auto insurance policy, you might notice that the insurance company name doesn’t exactly match an insurance brand you see in ads.

That’s because there’s a difference between an insurance company and an insurance group.

A company sells policies, collects premiums, pays claims.

A group consists of companies that it owns, each one offering coverages under different names.

Why this difference could matter:

- Financial strength ratings. Credit agencies like AM Best or Moody’s may rate the ability of companies — or sometimes the group — to pay claims. Check the rating for the company insuring you. Companies choose to be rated; so not every company will have a rating.

- Same group, different rules. Two companies that are part of an insurance group might offer different coverages, pricing, or customer service. Don’t assume all companies in a group are identical.

- Claims and service may differ. If you switch to a different company within the same group, you might notice different claim procedures, coverages, exclusions, and digital tools.

If you’re unsure which company is insuring you, ask your agent or the insurance company to explain.

Learn more

- Tips to help you shop for auto insurance

- Tips to help you shop for homeowners insurance

- Top 40 list of insurers in Texas

September 5, 2025

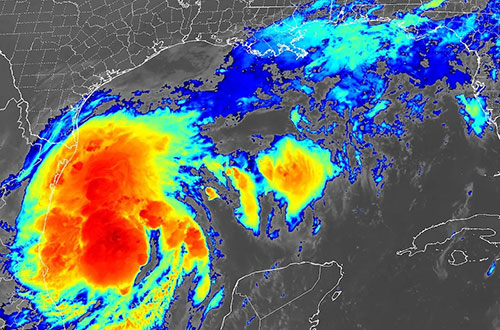

When a storm enters the gulf, it’s too late to ask: ‘Do I have enough insurance?’

Once a named storm enters the gulf, most insurance companies, including the Texas Windstorm Insurance Association (TWIA), stop selling new policies or making changes to existing ones.

That means you can’t wait until a storm is approaching to think about your insurance coverage, because you won’t be able to buy or change it then!

Of course, this is especially critical for Texans with homes near the Gulf Coast. But the effects of a hurricane, like flooding and tornado force winds, can extend well beyond the coast.

Which leads us to another key point, flood insurance. Most home policies don’t pay for damage from rising flood waters. Most people buy flood coverage from the National Flood Insurance Program. And unless you’re buying coverage for a new home, these policies don’t go into effect until 30 days after you buy them.

So again, you can’t wait until a storm is coming to ask: “Am I covered?”

Learn more

- Where else you can buy flood insurance

- How to prepare for a hurricane (video)

- Hurricane season: How to prepare your home and property

- Texas summer storm safety

- Hurricane Preparation Fact Sheet

August 27, 2025

Title insurance isn’t required by law. But it protects you.

Having a property title means you own the property and can sell, rent, or transfer ownership of the property. Title insurance protects you against problems with getting a title when you buy property.

Title insurance companies search for problems with a title that need to be corrected before it’s given to you. Possible problems could be:

- Unpaid property taxes.

- Fraud or forgery of a previous deed (the legal document used to transfer the title).

- A spouse or unknown heir who could make a claim against the property.

If there’s a challenge to your ownership later, your title company will handle the dispute.

If you’re borrowing money to buy a property, your lender will require you to buy a Loan Policy of Title Insurance (PDF) to protect their interest.

Otherwise, you can get peace of mind from an owner’s title insurance policy, which lasts for as long as you or your heirs own the property.

TDI sets premium amounts for title insurance policies sold in Texas, so the rates are the same for all title companies. It still might be worth researching title companies. You should make sure the title company is licensed and has good customer reviews. You also might want to check their closing costs, which can vary.

Learn more

August 6, 2025

Fire in your house? Get out fast.

If a fire breaks out in your home, you might have just minutes to escape.

So get out.

Leave.

Don’t hesitate.

Use these tips to plan how you’ll get your family and pets out safely:

- Make a home escape plan and practice it with everyone in your home. Have someone watch the drill and time it. Practice the plan until it’s automatic for everyone.

- Practice your escape plan twice a year. Try one practice at night, one in daylight.

- Practice finding more than one way out.

- Know at least two ways out of every room, if possible. Make sure exit doors and windows open easily.

- Agree on an outdoor meeting place—a tree, mailbox, light pole. Make sure everyone knows to go there.

- Teach your children how to escape without your help. Tell them not to hide under a bed, in a closet, or in a bathroom.

- Never go back inside a burning building. Get out and stay out!

Learn more

July 6, 2025

Can I make an insurance claim for additional living expenses?

Texans with flood damage might be wondering if their homeowner policies pay for hotels, food, and other expenses if they need to leave during repairs.

When do policies pay for additional living expenses?

Homeowners and renters policies may cover additional living expenses if you can’t stay in your home because it was damaged by an event that’s covered in your policy.

For example, you need to move out during repairs because a tornado damaged your house, and your home policy covers tornadoes.

If you left your house because of a power outage or evacuation – and your home wasn’t damaged – your policy won’t cover additional living expenses.

Does my home policy cover floods?

Most home policies don’t cover floods.

Some people buy flood insurance through the National Flood Insurance Program (NFIP). But NFIP policies don’t pay for additional living expenses.

If your home policy includes flood coverage, it probably will pay for additional living expenses.

Call your agent or company to ask if you have a NFIP flood policy or have flood coverage in your home policy.

Learn more

- Does your insurance cover additional living expenses? (video)

- When do policies pay for additional living expenses?

- Recovery tips

July 5, 2025

Insurance claim tips for Texas flood victims

The Texas Department of Insurance (TDI) reminds flood victims to document damages and file insurance claims quickly.

For home damage

- If you have flood insurance and your home flooded, call your company to file a claim as soon as possible. If you have a policy through the National Flood Insurance Program (NFIP), call 877-336-2627. NFIP policies require you to file a claim within 60 days.

If you have a flood policy through your insurance company but can’t find their phone number, we can help. Call us at 800-252-3439.

- Not sure if you have flood insurance? Most home and renters policies don’t cover flood damage, but a few do. Even if you don’t have flood coverage, you might need a denial from your insurance company to apply for federal disaster assistance if it becomes available.

- File a home insurance claim if you have other damage. Most home policies cover damage from wind or falling tree limbs. They’ll also cover damage to fences.

- Take photos or video of the damage as soon as it’s safe. Don’t throw away damaged items until you talk to your insurance adjuster.

For auto damage

- File an auto claim if your car flooded. Your auto policy covers flood damage if you have comprehensive coverage.

- Take photos or video of the damage. If it’s safe to do so, also take pictures of your car in the water.

- Talk to a mechanic before trying to dry out a car that got water inside.

For FEMA assistance

Homeowners and renters with damage or other storm-related costs not covered by insurance policies may be able to apply for federal disaster assistance.

If you have insurance questions, call our Help Line at 800-252-3439 from 8 a.m. to 5 p.m. Central time, Monday through Friday.

Learn more

- Help after a disaster

- Workers’ compensation resources for Central Texas flooding

- Storm damage? Here are 10 tips you need to know (video)

- FAQ: Homeowners insurance and disaster claims

- Flooded cars: What to know about insurance claims and repairs

- Insurance for RVs: Know your coverages

- When are water damage and mold covered by insurance?

- What if my insurance isn't paying enough?

- How to avoid contracting scams

July 1, 2025

Texas law encourages renters to buy flood coverage

A Texas law (House Bill 531) emphasizes that renters insurance doesn’t pay for flood damage.

Renters insurance, available for about $20 a month, pays to repair or replace the things you own if they’re damaged by fire, smoke, theft or vandalism, and certain kinds of water damage.

But most renters policies don’t pay for losses caused by floods.

Renters worried about flooding should consider buying a separate flood policy. Ask your agent if they sell flood insurance. If not, you can buy a policy from the National Flood Insurance Program. You can also call them at 877-336-2627.

Landlords are now required to:

- Tell potential renters if they know the dwelling is in a 100-year flood plain.

- Tell potential renters if they know the dwelling had flood damage at least once in the previous five years.

- Encourage renters to buy flood insurance.

Even if your home isn’t in a flood plain, you might want to consider a policy. Flooding can happen anywhere at any time. Poor drainage systems, broken water mains, neighborhood construction, and summer storms can result in flooding.

Learn more

- Flood insurance: Why you need a policy

- Renters insurance: What does it cover and how much does it cost?

- How do you know if you need flood insurance? (video)

June 19, 2025

RV, pool, or boat? Insurance for your summer survival tools

Texans typically use the heat index instead of the calendar to mark the arrival of summer. Whether you wait for a 100-degree day or the official summer solstice, summer is here. Stay cool, Texas. We’ve got ideas to beat the heat and make sure your investment is insured.

Hit the road: If you’re taking your vacation on the road this year, watch our video to understand how insurance works for your home on wheels.

Hit the pool: Thinking about adding a pool or outdoor kitchen to your home? Yes, please! It’s a big investment, so talk to your insurance agent or company about getting the right coverage.

Hit the lake: With thousands of lakes and 367 miles of coastline, it's no wonder Texas is home to more than half a million recreational boats. If you have a boat, your homeowners insurance may include enough coverage. To make sure, check our tips on boat insurance.

June 11, 2025

You live in a floodplain

Your home lender may only require flood insurance if you live in an area at high risk of flooding, but we all live in a floodplain. We talked to a FEMA expert about how flood insurance works and why you may need it.

Check FEMA’s Risk Mapping, Assessment and Planning to see if you live in or near a flood hazard area. But as the FEMA expert explained, even those living outside high risk areas may flood. He said as many as 65% of disaster assistance claims for flood damage have come from people living outside areas designated as flood hazard areas.

He also explained the limits of disaster assistance. It’s not a substitute for flood insurance. First, you can only get disaster assistance after a disaster declaration. And disaster assistance is designed to help you get back on your feet – to make your home livable – but not to rebuild it as it was before. For that, you need flood insurance.

Just one inch of water can cause $26,000 of damage to a home. To make sure you’re protected, ask your insurance agent or company about flood insurance.

To learn more, go to FloodSmart.gov or review these tips.

May 29, 2025

Power out, food spoiled? Your insurance might help.

If you lose power and the food in your refrigerator spoils, can your insurance help?

Possibly.

Some homeowners and renters policies will pay up to $500 for spoiled food if the power fails under certain circumstances. Call your agent or company to ask if your policy will pay. Sometimes there is not a deductible.

Take pictures or keep a list of the food that spoiled.

And clean any food spoilage to prevent damage to your refrigerator.

Have other insurance questions? Call the TDI Help Line, 800-252-3439, 8 a.m. to 5 p.m. weekdays.

Learn more

- Does your insurance cover additional living expenses? (video)

- When do policies pay for additional living expenses?

- FAQ: Homeowners insurance and disaster claims

- Creak! Crackle! Pop! Does insurance cover fallen tree branches?

May 9, 2025

Home insurance not renewed? You have options.

If your insurance company says it’s not renewing your Texas homeowners insurance, you have options.

The company must tell you about nonrenewal 60 days before your policy ends. This leaves time for you to shop for a policy meeting your needs and budget and have a new policy in place before your current policy expires.

About 160 companies sell home coverage in the state.

Tips for shopping:

- Get sample rates on TDI’s HelpInsure.com. Next, follow up with companies directly for quotes.

- Work with an independent agent who can help compare policies from different companies.

- Ask friends or family about their insurance providers.

If at least two companies decline to insure your home, you may buy a policy through the state’s provider of last resort, the Texas FAIR Plan Association.

Have an insurance question? Call TDI’s Help Line at 800-252-3439 weekdays from 8 a.m. to 5 p.m. Central time.

Learn more

- Was your home insurance canceled or not renewed?

- Other ways to get auto, home, and wind insurance in Texas

- Tips to help you shop for homeowners insurance

April 29, 2025

Does my roommate’s renters insurance cover my stuff?

If you lease your apartment or home with a roomie, you should each buy your own renters insurance.

Big yikes: Your roommate’s policy won’t pay for your stuff if it’s lost in a robbery or fire. Their policy covers only their belongings.

Renters insurance costs less than $20 a month.

Reasons to buy a policy:

- It pays for your belongings – clothes, electronics, home décor, furniture – if they’re damaged or stolen from your rental home or car and while you’re traveling.

- If you need to move out of your rental home while it’s being repaired, it might pay for rent somewhere else and food.

- It also covers medical expenses and your legal fees if someone is hurt at your place.

If your parents have homeowners insurance, their policy will pay a certain amount to replace your belongings. But it’s likely that renters insurance would probably cover more than the limits of your parents’ homeowners policy. Check with their insurance company to get coverage amounts.

Watch our video featuring tips about college students and insurance.

Learn more

- Insurance tips – college edition

- Renters insurance: What does it cover and how much does it cost?

- Do I need insurance for my self-storage unit?

- Texas law encourages renters to buy flood coverage

April 25, 2025

Tips to avoid a tornado: Follow weather reports

You’re driving home from work, inching along in highway traffic. Then you hear a tornado warning on the radio. Or worse, you see a tornado twisting your way.

Don’t get yourself into that situation!

A National Weather Service expert urges everyone to follow the weather, especially during the spring and summer tornado and hurricane seasons.

If your city or county is under a tornado watch, plan to be inside a building—and not sitting in your car or truck.

Learn more

- Danger, danger! Don’t mix up tornado watches and warnings.

- Are you prepared for a tornado? Here’s how to protect your home

April 21, 2025

TDI rate reviews save Texans millions on home and auto premiums

In Texas, the insurance industry is driven by market forces including demand for coverage, the cost of paying claims, and competition among the more than 322 companies selling home and auto insurance. Each insurance company determines the rates it charges its policyholders.

While the Texas Department of Insurance (TDI) does not set insurance rates, every year, our actuarial staff review thousands of rate filings made by insurance companies.

In 2024, TDI’s actuarial staff reviewed 2,343 rate filings. 132 filings were rejected for technical reasons, and another 174 were withdrawn by the companies.

An insurance company might withdraw a rate filing if they:

- Need more time to respond to TDI’s questions about the filing.

- Are forced to withdraw a filing because it doesn’t follow state law.

- Decide to make a new filing at a different rate.

Of the rate filings reviewed, TDI determined that 2,037 complied with Texas law. TDI staff had questions or asked companies to provide more information on 77% of filings.

This is where most of TDI’s regulatory work on rates happens—requiring insurance companies to provide more information on incomplete or insufficient filings.

This review process saves consumers on average more than $29.2 million a year.

Learn more

- How are your auto and homeowners insurance costs calculated?

- Ways to save money on home insurance

- Lower your car insurance rates: Tips for saving money

April 10, 2025

Protect or harden your home before bad weather hits

Texas gets more tornadoes than any other state and plenty of hail. Hurricanes too.

Homeowners can prep their homes for all kinds of bad weather.

Some tips:

- Trim your trees. Broken limbs can damage your roof, break windows, and more.

- Know where to shut off your utilities outdoors.

- Make sure any sheds, outdoor furniture, and grills are tied down so they don’t become flying objects in heavy wind.

- Make sure all your gutter fasteners are tight. If you live in a hail-prone area, consider upgrading your gutters to steel. Steel is more durable than vinyl or aluminum.

- Keep your roof in shape. As shingles age, they can lift or let water inside your home. When it’s time to replace your roof, use impact-resistant shingles and make sure they’re properly installed.

Learn more about protecting or “hardening” your home in an expert interview on the Texas Insurance Podcast.

Learn more

- Are you prepared for a tornado? Here’s how to protect your home.

- Are you ready for a disaster?

- Hurricane season: How to prepare your home and property

April 4, 2025

Danger, danger! Don’t mix up tornado watches and warnings

Ever mix up a tornado watch with a tornado warning?

Big difference!

- A tornado watch means keep an eye out for a possible tornado.

- A tornado warning means a tornado’s been spotted in your city or county.

Tornado warning in your area? Take cover.

People in a warning zone need to take cover immediately. If you’re in a vehicle, trailer, or mobile home, leave and head to the closest building if you have time.

If you’re in a house or building, go to an interior room, bathroom, or closet on the lowest level. Cover yourself with blankets, towels, or a mattress to stay safe from falling debris. Never open windows; it doesn’t help equalize pressure. But you should shut all your doors because that will help reduce the chance that your roof will blow off.

If you’re driving, don’t stop under bridges or overpasses. They don’t offer protection from tornadic winds or flying debris. If you can’t get to a building, lie flat and face down in the nearest ditch or depression. Cover your head with your hands.

Tornado watch in your area? Get ready.

Tune in to your local weather report to keep track of the tornado watch. Get ready to move to a safe space.

A tornado watch area is often large, covering counties, even states.

If you are under a tornado watch:

- Review your emergency plans.

- Bring in or secure outdoor objects that might blow around.

- Check supplies, such as batteries, flashlights, water, non-perishable food, and medicines.

- Identify your safe room.

Summing up: A tornado watch means get ready. A tornado warning means move quickly to safety.

Learn more

- Are you prepared for a tornado? Here’s how to protect your home

- What are some common facts about tornadoes? (video)

- For more insurance tips, visit our before the storm page.

- Division of Workers' Compensation tips: Tornado Safety (PDF) | Seguridad en caso de tornados (PDF)

March 28, 2025

Flooded home or car? What to do next.

If your home or car has flood damage, insurance could help you recover.

Some tips for property owners:

- Take photos or video of the damage as soon as it’s safe. Don’t throw away damaged items until you talk to your insurance adjuster.

- If your home floods, call your insurance company to file a claim as soon as possible. If you have a policy through the National Flood Insurance Program (NFIP), call 877-336-2627. NFIP policies require you to file a claim within 60 days. If you can’t find your insurer’s phone number, call the TDI Help Line at 800-252-3439.

- Most home and renters policies don’t cover flood damage, but there are exceptions. Even if you lack flood coverage, you still might need a denial from your insurance company to apply for disaster assistance if available.

You can also make an insurance claim if you have other damage. Most home policies cover damage from wind or falling tree limbs. They also might cover damage to fences and other structures on your property.

If your car floods:

- File an auto insurance claim if you have comprehensive coverage; it covers flood damage.

- Take photos or video of the damage. If it’s safe to do so, also take pictures of your car in the water.

- Talk to a mechanic before trying to dry out a car that got water inside. It may have hidden damage.

Have insurance questions? Call the TDI Help Line at 800-252-3439.

Learn more

- National Flood Insurance Program: How to file a claim

- Flooded cars: What to know about insurance claims and repairs

- When are water damage and mold covered by insurance?

- Can I make an insurance claim for additional living expenses?

- Steps to getting your home or car insurance claim paid

- How to avoid contracting scams

March 13, 2025

Do you know your home’s wildfire risk?

In 2011, the most destructive wildfire in Texas history destroyed more than 1,600 homes in Bastrop County. A decade later, wildfires continue to pose a risk to much of Texas – and the risk increases as population expands into wilderness areas.

You can use the Texas Wildfire Risk Assessment Portal to check the wildfire risk for your home. Just enter your address, and you’ll get a look at the risk for your property and the surrounding area. Then listen to our interview with the Texas A&M Forest Service about what you can do to reduce those risks and protect your home.

Learn more

- Wildfire risks: Projects to help you protect your home

- Texas wildfires: Insurance can cover home, auto damages.

January 31, 2025

How to file your insurance claim

Need to make an auto or home insurance claim?

Tips to help you succeed:

- After a car accident or incident at your home, talk to your insurance company. You’ll want to discuss your options. Maybe you don’t want to file a claim. Consider your deductible—how much you pay before your insurance pays.

- If you make a claim, write down details including when you called the company, who you talked to, and your adjuster’s name. Also, make a list of documents or information the company wants from you.

- After a car accident, move your car to a safe location. Take photos of the accident scene, including your car, other involved cars, and anything that’s been hit such as trees, buildings, or street signs. Also photograph the other driver’s insurance information, driver’s license, and license plate.

- If your house is damaged, write down the time and date you first saw the damage. Also note what the weather was like at the time. Take photos of any damage. Protect your home from further damage by covering broken windows or putting a tarp over a roof hole. Don’t make permanent repairs until your company gives the OK.

- On any claim, save all receipts.

.

Want more tips about making a claim? Listen to this Texas Insurance Podcast.

Learn more

- Tips for filing a claim with your insurance company

- Were you in a wreck? Tips for auto insurance claims

- Steps to getting your home or car insurance claim paid

January 16, 2025

Rating tied to local fire protection can affect home insurance

If you live in a city, it probably has a score tied to its fire protection capabilities.

That score could affect your homeowners insurance.

Each Public Protection Classification System (PPC) rating comes from an organization, the Insurance Services Office (ISO). Half of each rating is based on the local fire department’s record. The ISO also considers the water department and water supply, emergency communications, and community efforts to reduce fire risks.

That rating could affect your homeowners insurance and its cost. You can ask your insurance agent or company to check the current PPC rating for the location of your residence. Get more details about the PPC in this Texas Insurance Podcast.

Learn more

- FAQ: Public Protection Classification

- Public Protection Classification (PPC) Oversight

- How the State Fire Marshal’s Office helps Texans (PDF)

January 16, 2025

Another Texas freeze in forecast? Podcast has steps to protect your home.

Just saying “freeze” can make a Texan flinch.

But you can take steps to protect your home before temperatures drop.

For starters, wrap indoor pipes with insulation. Wrap your attic pipes first.

And when a freeze happens, you can run water through your indoor faucets – hot and cold – before you go to sleep. Or you can let faucets drip from the cold and hot taps. Be sure to follow your local government’s instructions, which may limit water use.

Hear more about prepping your home on “The Texas Insurance Podcast,” featuring David Yelovich, a Texas State Board of Plumbing Examiners board member. Our podcast closes with TDI advice on insurance and water-related damage.

January 15, 2025

Unknown fire hazards in your home

Most people know that stoves, ovens, and candles are dangerous and can start fires.

But there are other fire risks in your home that you might not have thought about:

- Dryers. Clean your lint filter before each use. Make sure the air exhaust vent pipe leads to the outside and is unblocked. Clean the lint out of your vent pipe every three months. There are tools available at local home improvement stores that allow you to do it yourself. Or, you can hire a professional or get your apartment’s maintenance to do this. You want clothes to be fire, not on fire.

- Kitchen appliances. Our kitchens have all sorts of gadgets, like air fryers, microwaves, and coffee makers. Plug your appliances into a wall outlet, never an extension cord. Place them where they won’t get bumped or knocked over.

- Lithium-ion batteries. Smartphones, laptops, hoverboards – so many devices in our homes now use lithium-ion batteries. Don’t overcharge your devices, and don’t place them on a pillow, bed, or couch while charging. Keep devices that use lithium-ion batteries at room temperature.

If there is a fire in your house, get out and stay out. Use your cell phone to call for help or ask a neighbor to call 911.

December 6, 2024

Protect your home while you’re away

Before you head out for a vacation, we have some tips to keep your home safe while you’re gone.

Set timers on interior lights. Criminals are looking for an easy target. Use a timer on a few lights to make it appear that someone is home, and don’t let newspapers or mail pile up. Make sure valuables aren’t visible to someone looking through windows, and never leave a key outside.

Don’t post on social media. It’s best not to post that you’re away even if you think only friends and family can see your social media accounts.

Lock doors and windows. It’s obvious, but it’s also easy to forget. Before you leave, take one last trip around the house to make sure everything is locked.

Unplug TVs and computers. It’s Texas so you never know when an electrical storm could cause a power surge. To protect expensive electronics, unplug them or use a surge protector.

September 12, 2024

How to make a home inventory for insurance

Ever heard of a home inventory?

It’s not a list of homes.

It’s a list of stuff inside your home that you’d want to replace when making an insurance claim after a theft, flood, fire or other disaster. Items in an inventory include furniture, clothing, appliances, silverware, glassware, and other personal property.

In this Texas Insurance Podcast, TDI’s Margo Morris shows how to make your inventory.

Learn more

September 9, 2024

How to prepare for a hurricane or tropical storm

Hurricanes and tropical systems can bring strong winds and rain. Here’s how you can prepare:

1. Invest in a weather radio

Have a way to get updates if cell services or power lines go down. Many weather radios now work as backup power banks with ports to plug in your phone and with solar and crank handles to recharge the battery.

2. Add your agent to your phone contacts

Put your agent and insurance company in the contact list on your phone. Make copies of important documents, such as your policy’s declaration page and auto and health ID cards and email them to yourself so you can get to them if you have to evacuate.

3. Prepare your home

- Remove dead tree limbs and branches that hang over your house.

- Check for items that can become windborne, such as yard furniture or trampolines, and tie them down or bring them inside.

- Clean gutters to let the water drain faster.

- Close doors to keep your roof on.

- If you plan on using a generator if the power goes out, make sure you have enough fuel. If you haven’t used it in a while, make sure it starts.

4. Be ready to evacuate

- Pack a bag with your insurance policies, home inventory, health plan cards, medication, water, and food in case you need to leave your house.

- If you have pets, make sure you have their vaccination records, food, water, leash, collar, tags, and crate.

- Keep your gas tank full.

- Plan an evacuation and a backup evacuation route.

- Let family members know where you’ll meet if you need to evacuate.

5. Listen to the news

Follow any evacuation orders from your local government.

Learn more

- How to prepare for a hurricane (video)

- Before the storm

- Home inventory (video)

- How to safely use a portable generator (video)

- How to prepare for hurricane season (video)

- Texas Division of Emergency Management (TDEM) Disaster information page

August 22, 2024

Am I covered by insurance when I rent a scooter?

Before you rent or jump on one of those cute zippy scooters, remember these tips.

- Scooter rental companies don’t cover you in case of accident or injury. Rental agreements give you all liability. That means you could be paying for any damages and injuries, not just your own.

- Home policies usually don’t cover damage from motorized vehicles and your auto policy probably won’t extend to an electric scooter.

- Don’t forget to read your scooter rental agreement before you ride. And to be safe, wear a helmet.

So, what covers scooter accidents? Your health insurance probably will cover your injuries—though it won’t cover anyone in your path.

Learn more

- Electric scooter insurance: What to know before you hop on

- Does insurance cover ATVs and golf carts?

- Do I need insurance for a motorcycle or moped?

August 5, 2024

Get a free clue about your insurance claims history

Wondering why you’re paying more for home or auto coverage than your neighbor?

It might have to do with past insurance claims.

The good news is that you can get details for free by asking for a report.

What’s the report? It’s the Comprehensive Loss Underwriting Exchange or CLUE report. It shows claims filed for homes and cars for the past seven years. Most insurance companies report information based on filed claims, including:

- Date of loss.

- Loss type.

- Amount paid on claim.

How do I get a report? You can get a report on any property you own by contacting LexisNexis. Click on “Request a Consumer Disclosure Report.” You can contact LexisNexis to dispute incorrect information in the report or to add an explanation.

If you’re buying a home or car, you can ask the current owner for the report.

Learn more

- How to get a CLUE about your claims history

- Buying a new home? What you need to know about insurance. (video)

July 1, 2024

Biking and insurance pedal together

When you ride your bike, insurance rides with you. For instance, if your bike is stolen, your homeowners or renters policy might cover replacement, though your coverage might have a dollar limit.

Read your policy or contact your agent to be sure.

If you bike often, you may want to ask your agent about liability coverage. If you cause an accident that results in property damage or injures someone, liability insurance could help cover costs you’re responsible for. If you have home or renters insurance, it likely includes liability coverage.

March 14, 2024

Any place can flood. Do you have flood insurance?

It can rain and flood anywhere. And most home insurance policies don’t cover flood damage. You might want to buy flood insurance.

One inch of water in a home or apartment can cause up to $26,000 in damage.

To shop for coverage, talk to your insurance provider. If they don’t offer a flood policy, go online to floodsmart.gov to find providers.

A flood policy takes effect 30 days after purchase. It’s wise to shop before hurricane season, which begins June 1.

Get expert advice on flood insurance in this Texas Insurance Podcast.

Learn more

- Flood insurance: Why you need a policy

- You live in a flood plain

- Hurricane season: How to prepare your home and property

February 29, 2024

Texas wildfires: Insurance can cover home, auto damages.

Your insurance can apply if a wildfire damages or destroys your home or car.

Some insurance tips:

- Homeowners insurance will pay to repair or replace your home or property if it is damaged or destroyed in a fire or storm, up to the policy limits. You’ll have to pay your deductible. Damage from an explosion or smoke also is typically covered.

- If you can't stay in your home because of damage covered by your policy, your homeowners or renters policy may pay for a hotel or rental. Check your policy for limits on the coverage.

- Your car is covered if you have comprehensive coverage. Some policies will pay for a rental car if yours is damaged.

- Call your agent or read your policy to check details.

Questions? Call the Texas Department of Insurance’s Help Line at 800-252-3439, 8 a.m. to 5 p.m. Monday to Friday.

Learn more

- Steps to getting your home or car insurance claim paid

- Recovery tips

- Working with an insurance adjuster

- How to avoid contracting scams

November 29, 2023

Five reasons to always lock your car or truck

Locking up your car or truck might seem a little thing. But always locking up protects you and your property.

Here’s why to lock up:

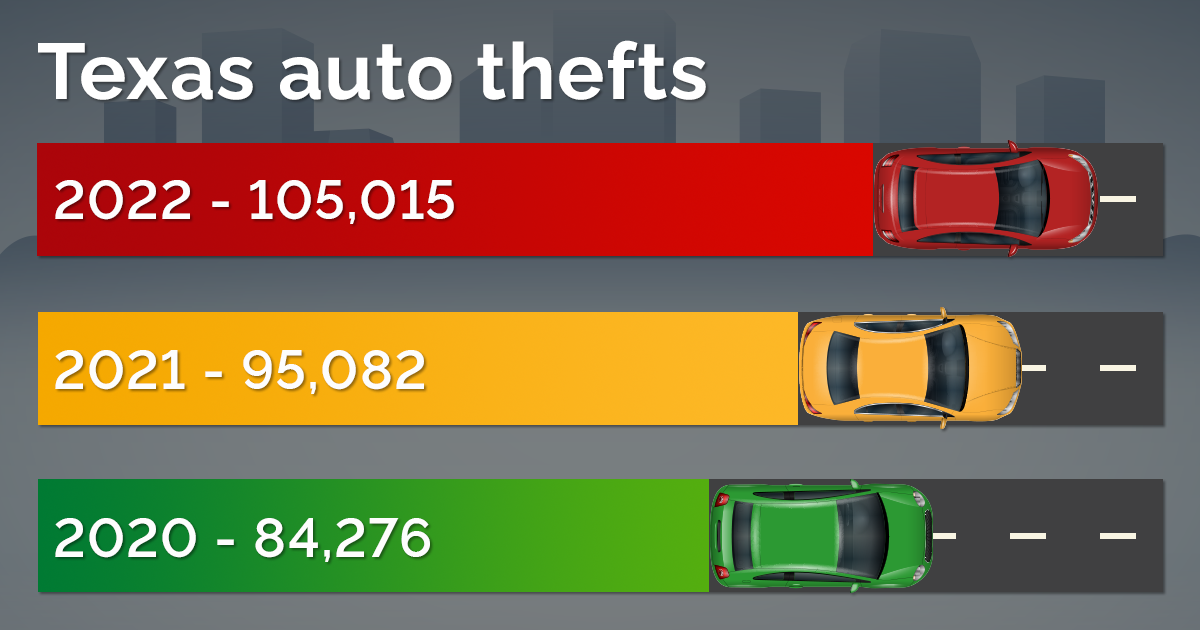

- Theft happens a lot. In the U.S., a car is stolen once every 32 seconds. And car theft went up 7% in 2022, according to the National Insurance Crime Bureau.

- Theft costs money. The average loss per Texas motor vehicle theft topped $12,000 in 2020.

- Leave your keys, risk your ride. Driver error, such as keys left in a vehicle or leaving it unlocked, is a factor in about half of all auto thefts. In Texas in 2017 through 2019, more than 17,000 stolen vehicles involved keys left in the car or truck.

- Burglaries happen fast. A criminal can grab valuables in seconds. The crime that police call “sliding” targets unlocked cars briefly parked at stores such as gas stations. A thief sneaks up one side of the vehicle, opens a door, slides in, takes items, and slips away.

- Lock up as soon as you’re in your car. Car or truck doors may automatically lock once you’re driving. But locking up as soon as you get in the driver’s seat better protects you from surprise break-ins.

Learn more

Auto theft and insurance: How to protect your ride

Car burglaries and break ins are increasing. Here's how to protect your car (podcast)

October 12, 2023

Prevent cooking fires, protect your home

Cooking fires are the No. 1 cause of home fires.

So do right in your kitchen and protect your home.

Cooking safety tips:

- Once you start cooking, keep your eyes on the sizzle. Inattention can lead to flames you don’t want.

- Try not to leave the kitchen while cooking — and never ditch a hot stovetop. If you stray from your oven, set a timer so you’re back before dinner chars.

- If children are afoot, keep them 3 feet away from your cooking zone, indoors or out. Enforce the zone for your pets too.

Get more tips in our cooking safety podcast featuring Kelly Ransdell of the National Fire Protection Association. The association marks National Fire Prevention Week each October.

Learn more

- How to prevent kitchen fires with our cooking safety tips

- Is your kitchen too hot to handle? (video)

- How to make a home fire escape plan (video)

September 7, 2023

How to shop for home insurance

Are you wanting to lower your home insurance costs?

Consider shopping for a new policy. Plan ahead by starting a month or more before your current policy expires.

Shopping tips:

- Ask your agent if a premium increase or other changes in your policy are in the works. This helps you make comparisons.

- Consider a higher deductible, which could reduce your premium.

You can hear more on shopping for home insurance in the Texas Insurance Podcast.

Learn more

- How much home insurance do you need? (video)

- Ways to save money on home insurance

- Lower your home insurance cost by asking for discounts

- How to shop smart for home insurance

- FAQ: Homeowners insurance, claims, saving money, and more

August 3, 2023

Coastal Texans can turn to TWIA for hail, windstorm coverage

In August 1970, Hurricane Celia slammed ashore at Corpus Christi, killing and injuring residents and leaving previously unheard-of hundreds of millions of dollars in damage.

In response to insurance companies increasing rates or no longer selling wind and hail coverage along the Gulf Coast, state lawmakers in 1971 launched the Texas Windstorm Insurance Association (TWIA).

TWIA continues to serve as the wind and hail insurer of last resort for property owners in Texas’ 14 coastal counties and parts of Harris County. TWIA currently backs more than 237,000 policies.

If you live in a coastal community, read your homeowners policy to see if it covers hail and wind damage. If not, contact your insurance agent to see what options you have for coverage.

Eric Casas, TWIA ombudsman at the Texas Department of Insurance, cautions against assuming you can go without wind or hail coverage just because your home hasn’t been hit by a terrible storm. And if you have a mortgage, your lender will likely require you to have windstorm coverage.

Hear more tips about protecting your home from hail and wind damage in this episode of the Texas Insurance Podcast.

Learn more

- What is windstorm insurance?

- Texas Windstorm Insurance Association

- Homeowners, flood, and wind and hail policies: Know how they work

- What you need to know about windstorm inspections

July 6, 2023

Have an insurance complaint? Tips to understand the complaint process

Have a problem with your insurance company, agent, or adjuster?

You might want to file a complaint with the Texas Department of Insurance (TDI).

Before you consider a complaint, talk to your insurance agent or company about the problem you’re having. Sometimes conversations clear the air, delivering satisfaction.

You can file a complaint with TDI about insurance companies, agents, and adjusters. We can help you get started.

After you file a complaint, our experts will reach out to the insurance company to get more information. Last year, we returned $56 million to consumers in refunds and claim payments.

Before you file a complaint, understand that there are some things we can’t do:

- We can’t make a company pay a claim unless the failure to pay violates a law or the terms of your policy.

- We can’t help with complaints against another person’s insurance company. For instance, we probably won’t be able to help you if you’re in an accident and the other driver’s insurance company won’t accept liability.

- We can’t decide who was at fault in an accident.

Questions? Call our Help Line at 800-252-3439 to understand your rights. For more on filing a complaint, watch this Texas Insurance podcast.

View podcast Q&A: How to get help with an insurance complaint

Learn more

- Can TDI help with my complaint? (video)

- What if my insurance isn't paying enough?

- Not sure who to call with your question or complaint? We can help.

April 6, 2023

Prepare your home and family for spring Texas storms

A spring hurricane is unlikely. The latest one, Hurricane Alma, fizzled out near Cuba in May 1970.

Still, spring rains, hail, wind and even tornadoes can threaten homes, cars, and lives.

Some storm preparation tips:

- Paul Yura of the National Weather Service suggests you keep three days of food, water and other supplies, including pet food, on hand.

- Also, Yura says, decide well ahead of time where your family will go if dangerous weather approaches.

- Count on weather alerts on your cell phone. But, Yura says, also keep a weather radio handy, with fresh batteries. Sometimes the phone runs out of juice.

View podcast Q&A: How to prepare for spring storms

Learn more

- Texas summer storm safety

- 5 tips for driving in windy conditions

- Are you ready for a disaster?

- Tips to avoid a tornado: Follow weather reports

Insurance tips and help

How to get help or file a complaint: We can answer insurance questions, help with problems, and explain how to file a complaint against an insurance company or agent.

Videos: Our video library has short tips and interviews with experts on dozens of topics.

Insurance tips: Use our tips to get the best deal on insurance, protect yourself from fraud, and learn what to do when you have a problem.