February 9, 2026

Do you need flood insurance as a renter?

If you rent your home or apartment, you may have bought renters insurance to protect your belongings from theft, fire, or damage from a burst pipe.

But there’s more to consider. Renters policies typically don’t pay for losses due to floods. But a flood insurance policy could.

If a flood causes damage or loss, your flood policy covers personal belongings such as clothing, furniture, electronics, kitchenware, and curtains.

A flood policy doesn’t cover cash, precious metals, stock certificates, and other valuable papers. A policy also doesn’t cover cars, trucks, or personal property kept in a basement.

Shop before storm season. It typically takes 30 days for a flood policy to take effect.

Ask your insurance agent if they sell flood insurance. If not, you can buy a policy from the National Flood Insurance Program. You can also call them at 877-336-2627.

Learn more

- Renters insurance: What does it cover and how much does it cost?

- Texas law encourages renters to buy flood coverage

- Flood insurance: Why you need a policy

January 24, 2026

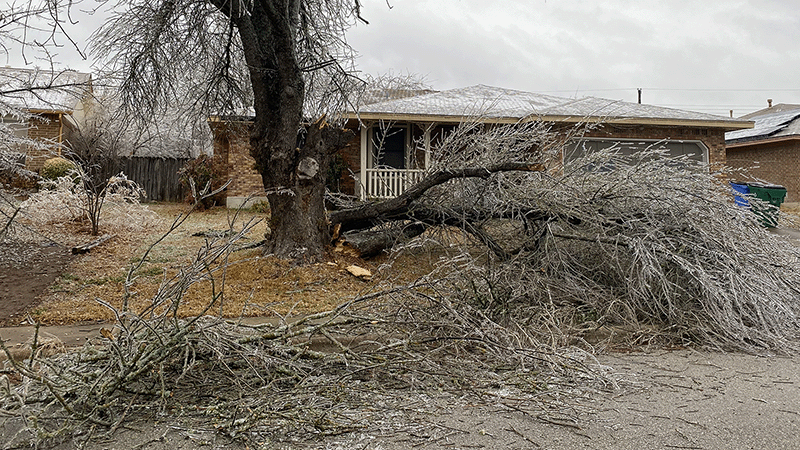

Does insurance cover fallen tree branches?

Will insurance pay when a tree crashes down on your car or house?

Sometimes.

If a tree or branch falls on your house or car, use these tips:

- Take photos of the damage before you move the tree, make repairs, or take other steps to prevent more damage.

- Make temporary repairs to prevent more damage, and contact your agent or insurance company as soon as possible.

- Save your receipts for reimbursement. Your homeowner policy should cover materials and labor used to make repairs.

FAQ about trees that fell in your yard

A tree fell on my house and damaged my roof. Will my homeowners pay for repairs?

Many policies pay for damages from falling objects, like trees. Call your agent or company to ask if your policy will pay.

A tree fell in my yard. Will my homeowners policy pay for tree removal?

Many policies provide some coverage to remove trees or limbs that fell due to storm damage and damage your house or block your driveway. Trees and limbs falling in your yard usually aren’t covered. Call your agent or company to ask if your policy will pay.

My neighbor's tree fell on my house. Will my neighbor´s homeowners policy pay for the damage and tree removal?

Probably not, unless your neighbor was at fault. Your neighbor isn’t responsible for acts of nature. If your neighbor's policy doesn’t pay, you can file a claim under your own policy.

A tree fell on my car. Will my auto insurance pay for the damage to my car?

Your auto policy will pay for damages if you have comprehensive coverage.

If the tree was your neighbor’s, their homeowners insurance might pay if your neighbor is somehow at fault. If not, their policy likely won’t pay because your neighbor isn’t responsible for an act of nature.

Other questions? Call our Help Line at 800-252-3439.

Learn more

January 23, 2026

Avoid frozen pipes and costly water damage by taking steps now

Freezing temperatures can cause frozen pipes.

But by taking simple steps now, you could head off thousands of dollars of water damage to your walls, ceilings, carpets, and furniture.

Key tips

- Install inexpensive wraps on exposed pipes. Start in the attic, where many Texas homeowners saw pipes freeze last winter.

- Wrap your outdoor faucets.

- Whether you own your home or live in an apartment or condo, identify water shutoff valves indoors and out. This will ready you for cutting off the water if a freeze poses risks.

- Don’t delay preparations until a freeze looms. Act now to ease your worries.

In this TDI video, How to prevent pipes from freezing, an expert with the Texas State Board of Plumbing Examiners shows several preventive steps you can take (plus, he spots a toad).

Learn more

- How to prepare your home for a winter storm (video)

- When are water damage and mold covered by insurance?

January 21, 2026

Ways to stay safe during cold weather

Wintry conditions could lead more Texans to rely on space heaters and other ways to stay warm. The Texas State Fire Marshal’s Office shares these tips to stay safe.

Caution with space heaters

In the last few years, several fatal fires in Texas were started by space heaters. Here are tips for keeping your family safe.

- Inspect a heater before you use it. Make sure there are no cracked or broken plugs or loose connections.

- Always plug space heaters directly into a wall outlet. Don’t use extension cords or power strips.

- Keep your space heater at least three feet from anything that can burn.

- Turn off your space heaters before you leave the room or go to bed. Look for models that shut off automatically when tipped over.

Avoid carbon monoxide poisoning

Cars, trucks, stoves, grills, fireplaces, and many appliances that burn fuel can generate carbon monoxide. You can’t see or smell it, but if enough builds up, it can be deadly.

If there’s too much carbon monoxide nearby, you may feel short of breath, have a headache, or feel dizziness, nausea, or weakness.

Use these tips to protect your family from carbon monoxide poisoning:

- Test carbon monoxide and smoke alarms.

- Never leave a car or truck running in a garage.

- Never use a charcoal grill or portable camping stove inside.

- Never use a portable generator in your home or garage, even if doors and windows are open. Only use these devices outdoors, and more than 20 feet away from open doors or windows.

- Never use a stove to heat your home.

- When using a fireplace, make sure first that the flue is open.

- If your carbon monoxide or smoke alarm go off, do not ignore it. When the alarm sounds, make sure everyone goes outdoors. Call 9-1-1 and stay outdoors until emergency responders say it’s safe to go back in.

Resources

- Space heater safety: Tips to prevent fires

- How to avoid carbon monoxide poisoning at home

- Know the dangers of carbon monoxide poisoning

- Using a generator? Stay safe from carbon monoxide

December 11, 2025

Prepare now for winter driving hazards

Now’s the time to get ready for winter driving hazards. Don’t wait until freezing temperatures arrive to shop for de-icer and an ice scraper – get them now so they’re ready when you need them.

Maintaining your tires is also an important part of preparing. Tires affect how your vehicle handles on roads made slippery by ice, snow, and rain. Get your tire pressure and tread depth checked and replace worn out tires.

If you must drive in wintery weather, give yourself plenty of time and keep an emergency kit in your vehicle in case you get stuck by ice and closed roads. The Texas Department of Public Safety (DPS) recommends storing water, jumper cables, a flashlight, and blankets in your vehicle and keeping your gas tank at least half full.

If you get in trouble on the road:

- Reduce your speed.

- Pull onto the shoulder or a grassy area.

- Keep your car running.

- Turn on headlights and hazard lights so others can see you.

If you need help, call the Texas Roadside Assistance number on the back of your Texas Driver License at 800-525-5555. That connects you to DPS and they can dispatch a trooper to you. Just keep in mind that it could take the trooper a while to reach you in bad weather.

Learn about preparing for winter driving hazards in TDI's Texas Insurance Podcast.

December 5, 2025

Prepare your home before winter’s fury hits

Winter’s cold can freeze and burst your home’s pipes, causing costly misery.

But you can prepare before the temperature falls.

Before a freeze:

- Wrap outdoor and indoor pipes in unheated areas (like a clothes washer in your garage).

- Remove water hoses and wrap outdoor pipes.

- Drain and turn off your lawn sprinkler system.

Inside, open cabinets under sinks to let your home’s heat warm the pipes. Let faucets drip from the cold and hot taps or run water through your indoor faucets – hot and cold – before you go to sleep.

If your pipes freeze, turn off the water at the shutoff valve. This prevents broken pipes from leaking into your house after they thaw.

Learn about prepping your home and car for winter’s cold in TDI's Texas Insurance Podcast.

Learn more

- Winter storms: Tips for preparing your house and pipes

- How to prevent pipes from freezing (video)

- How to make your house winter-ready

December 1, 2025

Staying safe when lightning strikes

In any given year, your odds of getting struck by lightning are less than one in a million. Doesn’t sound too bad, right? But across your lifetime, the odds don’t look that great – they go to one in 15,300. Of course, the odds of you getting hit go higher if you ignore the dangers of thunderstorms.

Heed these tips and avoid zaps from the sky:

- If you’re outdoors and you see lightning or hear thunder, enter a sturdy building or get inside a car and close the windows.

- Stay away from utility poles and metal fences. And get out of cars with soft tops, tractors, and motorcycles.

- Don’t lie flat on the ground or in a ditch. Run to the nearest building or car. If your hair stands on end, squat down, and put your head between your knees.

- If you’re indoors, stay away from windows, plugged-in appliances, computers, and power tools. And don’t take a shower or bath, wash dishes, or stand near plumbing; water pipes conduct electricity.

There are also ways to protect your house from lightning.

Homeowners can invest in a lightning protection system, which has three parts:

- Lightning rod: Intercepts the lightning.

- Down conductor: Takes energy from the lightning down the side of the building.

- Ground terminals or grounding rods: Takes the energy from the down conductor and puts it deep into the ground.

If you want to install a lightning protection system, hire a professional certified by the Lightning Protection Institute.

In this video, John Jensenius of the National Lightning Safety Council talks about:

- Common outdoor activities that put people at risk of being struck by lightning.

- The odds of getting struck.

- How to protect your home.

Learn more

September 5, 2025

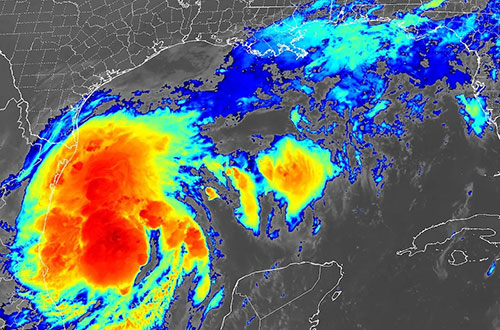

When a storm enters the gulf, it’s too late to ask: ‘Do I have enough insurance?’

Once a named storm enters the gulf, most insurance companies, including the Texas Windstorm Insurance Association (TWIA), stop selling new policies or making changes to existing ones.

That means you can’t wait until a storm is approaching to think about your insurance coverage, because you won’t be able to buy or change it then!

Of course, this is especially critical for Texans with homes near the Gulf Coast. But the effects of a hurricane, like flooding and tornado force winds, can extend well beyond the coast.

Which leads us to another key point, flood insurance. Most home policies don’t pay for damage from rising flood waters. Most people buy flood coverage from the National Flood Insurance Program. And unless you’re buying coverage for a new home, these policies don’t go into effect until 30 days after you buy them.

So again, you can’t wait until a storm is coming to ask: “Am I covered?”

Learn more

- Where else you can buy flood insurance

- How to prepare for a hurricane (video)

- Hurricane season: How to prepare your home and property

- Texas summer storm safety

- Hurricane Preparation Fact Sheet

August 13, 2025

Will your car’s rubber tires keep you safe from a lightning strike?

True or false: Your car’s rubber tires will protect you if lightning strikes your car.

False!

John Jensenius of the National Lightning Safety Council says it’s the type of car – not the tires – that protect you from lightning. You’re the safest in a hard-topped vehicle. When lightning hits, he says, the shock gets dispersed by your car’s metal shell and keeps the people inside safe.

Tire twist: If your car or truck has steel-belted tires, a lightning strike can blow them out.

Learn more from Jensenius about staying safe from lightning on this Texas Insurance Podcast.

Learn more

Thunderstorms: How to protect yourself from lightningJuly 6, 2025

Can I make an insurance claim for additional living expenses?

Texans with flood damage might be wondering if their homeowner policies pay for hotels, food, and other expenses if they need to leave during repairs.

When do policies pay for additional living expenses?

Homeowners and renters policies may cover additional living expenses if you can’t stay in your home because it was damaged by an event that’s covered in your policy.

For example, you need to move out during repairs because a tornado damaged your house, and your home policy covers tornadoes.

If you left your house because of a power outage or evacuation – and your home wasn’t damaged – your policy won’t cover additional living expenses.

Does my home policy cover floods?

Most home policies don’t cover floods.

Some people buy flood insurance through the National Flood Insurance Program (NFIP). But NFIP policies don’t pay for additional living expenses.

If your home policy includes flood coverage, it probably will pay for additional living expenses.

Call your agent or company to ask if you have a NFIP flood policy or have flood coverage in your home policy.

Learn more

- Does your insurance cover additional living expenses? (video)

- When do policies pay for additional living expenses?

- Recovery tips

July 5, 2025

Insurance claim tips for Texas flood victims

The Texas Department of Insurance (TDI) reminds flood victims to document damages and file insurance claims quickly.

For home damage

- If you have flood insurance and your home flooded, call your company to file a claim as soon as possible. If you have a policy through the National Flood Insurance Program (NFIP), call 877-336-2627. NFIP policies require you to file a claim within 60 days.

If you have a flood policy through your insurance company but can’t find their phone number, we can help. Call us at 800-252-3439.

- Not sure if you have flood insurance? Most home and renters policies don’t cover flood damage, but a few do. Even if you don’t have flood coverage, you might need a denial from your insurance company to apply for federal disaster assistance if it becomes available.

- File a home insurance claim if you have other damage. Most home policies cover damage from wind or falling tree limbs. They’ll also cover damage to fences.

- Take photos or video of the damage as soon as it’s safe. Don’t throw away damaged items until you talk to your insurance adjuster.

For auto damage

- File an auto claim if your car flooded. Your auto policy covers flood damage if you have comprehensive coverage.

- Take photos or video of the damage. If it’s safe to do so, also take pictures of your car in the water.

- Talk to a mechanic before trying to dry out a car that got water inside.

For FEMA assistance

Homeowners and renters with damage or other storm-related costs not covered by insurance policies may be able to apply for federal disaster assistance.

If you have insurance questions, call our Help Line at 800-252-3439 from 8 a.m. to 5 p.m. Central time, Monday through Friday.

Learn more

- Help after a disaster

- Workers’ compensation resources for Central Texas flooding

- Storm damage? Here are 10 tips you need to know (video)

- FAQ: Homeowners insurance and disaster claims

- Flooded cars: What to know about insurance claims and repairs

- Insurance for RVs: Know your coverages

- When are water damage and mold covered by insurance?

- What if my insurance isn't paying enough?

- How to avoid contracting scams

July 1, 2025

Texas law encourages renters to buy flood coverage

A Texas law (House Bill 531) emphasizes that renters insurance doesn’t pay for flood damage.

Renters insurance, available for about $20 a month, pays to repair or replace the things you own if they’re damaged by fire, smoke, theft or vandalism, and certain kinds of water damage.

But most renters policies don’t pay for losses caused by floods.

Renters worried about flooding should consider buying a separate flood policy. Ask your agent if they sell flood insurance. If not, you can buy a policy from the National Flood Insurance Program. You can also call them at 877-336-2627.

Landlords are now required to:

- Tell potential renters if they know the dwelling is in a 100-year flood plain.

- Tell potential renters if they know the dwelling had flood damage at least once in the previous five years.

- Encourage renters to buy flood insurance.

Even if your home isn’t in a flood plain, you might want to consider a policy. Flooding can happen anywhere at any time. Poor drainage systems, broken water mains, neighborhood construction, and summer storms can result in flooding.

Learn more

- Flood insurance: Why you need a policy

- Renters insurance: What does it cover and how much does it cost?

- How do you know if you need flood insurance? (video)

June 11, 2025

You live in a floodplain

Your home lender may only require flood insurance if you live in an area at high risk of flooding, but we all live in a floodplain. We talked to a FEMA expert about how flood insurance works and why you may need it.

Check FEMA’s Risk Mapping, Assessment and Planning to see if you live in or near a flood hazard area. But as the FEMA expert explained, even those living outside high risk areas may flood. He said as many as 65% of disaster assistance claims for flood damage have come from people living outside areas designated as flood hazard areas.

He also explained the limits of disaster assistance. It’s not a substitute for flood insurance. First, you can only get disaster assistance after a disaster declaration. And disaster assistance is designed to help you get back on your feet – to make your home livable – but not to rebuild it as it was before. For that, you need flood insurance.

Just one inch of water can cause $26,000 of damage to a home. To make sure you’re protected, ask your insurance agent or company about flood insurance.

To learn more, go to FloodSmart.gov or review these tips.

May 29, 2025

Power out, food spoiled? Your insurance might help.

If you lose power and the food in your refrigerator spoils, can your insurance help?

Possibly.

Some homeowners and renters policies will pay up to $500 for spoiled food if the power fails under certain circumstances. Call your agent or company to ask if your policy will pay. Sometimes there is not a deductible.

Take pictures or keep a list of the food that spoiled.

And clean any food spoilage to prevent damage to your refrigerator.

Have other insurance questions? Call the TDI Help Line, 800-252-3439, 8 a.m. to 5 p.m. weekdays.

Learn more

- Does your insurance cover additional living expenses? (video)

- When do policies pay for additional living expenses?

- FAQ: Homeowners insurance and disaster claims

- Creak! Crackle! Pop! Does insurance cover fallen tree branches?

May 23, 2025

TDI prepares to help Texans before hurricane season begins

Hurricane season runs from June through November. To prepare, the Texas Department of Insurance (TDI) recommends you make a home inventory, review your insurance policies, consider buying flood insurance, and check the condition of your windows and roof to reinforce your home’s hardiness where you can.

In 2001, TDI, the Texas Division of Emergency Management, and the Institute for Business & Home Safety founded the Texas State Disaster Coalition. Members of the coalition, including dozens of stakeholders from the Red Cross to insurance companies, can be activated as part of TDI’s disaster response.

Before hurricane season, TDI staff make sure coalition members have what they need. Also, TDI volunteers commit to join disaster response teams as needed.

Randall Evans, who heads the Consumer Protection Division, said: “As the frequency and severity of storms have increased, we have adjusted the model of our disaster program and increased our resources, escalating our readiness.”

After a hurricane, TDI’s role is to give insurance-related information to the public, handle consumer complaints, and make sure that filed claims are handled appropriately. Staff also investigate unfair or illegal practices.

“The Texas Department of Insurance prepares for weather disasters year-round,” said TDI Commissioner Cassie Brown. “We are ready to help Texans.”

Have an insurance question or concern? Call TDI’s Help Line, 800-252-3439, weekdays from 8 a.m. to 5 p.m. Central time.

Learn more

Hurricane season: How to prepare your home and property

May 22, 2025

Experts predict an active hurricane season. Use our tips to prepare.

Texas and the U.S. could be in for a busy hurricane season.

The National Oceanic and Atmospheric Administration (NOAA) predicts that 13 to 19 named storms could develop over the Atlantic Ocean during hurricane season, which runs from June to November. Six to ten of the storms could develop into hurricanes, NOAA says, three to five of them major storms.

Colorado State University experts expect 17 named storms, including 11 hurricanes, five of them major storms. They warn there’s an 70% chance that a named storm hits Texas this hurricane season.

The good news is that Texans have time now to prepare.

Some tips:

- Consider buying flood insurance. Flood damage isn’t usually covered by your home insurance. Don’t wait long: It typically takes 30 days for flood policies to take effect.

- Write a family disaster plan. Start on the TexasReady.gov website

- Decide where and how far you’ll go if you evacuate.

- Build a “go kit” with food, medicine, clothes, pet food, and other vital supplies.

- Make a room-by-room home inventory. This could help later if you file a claim.

Learn more

Plan to be safe before a hurricane hits Texas

Hurricane season: How to prepare your home and property

Flood insurance: Why you need a policy

May 15, 2025

An emergency go kit helps you survive a disaster

Texas gets walloped by hail, tornadoes, hurricanes—even freezing blizzards.

Before disaster looms, put together an emergency go kit so you and your family can scoot in a hurry.

Some emergency kit tips:

- Set aside three gallons of water per person, enough to last three days.

- Also pack non-perishable food, a can opener, utensils, battery-powered radio, flashlight, and extra batteries. Remember to have chargers for your gizmos and cell phone too.

- Put water and food supplies in your car, just in case.

An expert talks about how to build your kit in this Texas Insurance Podcast.

Learn more

- Build a kit (Texas Division of Emergency Management)

- TexasReady.gov

April 25, 2025

Tips to avoid a tornado: Follow weather reports

You’re driving home from work, inching along in highway traffic. Then you hear a tornado warning on the radio. Or worse, you see a tornado twisting your way.

Don’t get yourself into that situation!

A National Weather Service expert urges everyone to follow the weather, especially during the spring and summer tornado and hurricane seasons.

If your city or county is under a tornado watch, plan to be inside a building—and not sitting in your car or truck.

Learn more

- Danger, danger! Don’t mix up tornado watches and warnings.

- Are you prepared for a tornado? Here’s how to protect your home

April 4, 2025

Danger, danger! Don’t mix up tornado watches and warnings

Ever mix up a tornado watch with a tornado warning?

Big difference!

- A tornado watch means keep an eye out for a possible tornado.

- A tornado warning means a tornado’s been spotted in your city or county.

Tornado warning in your area? Take cover.

People in a warning zone need to take cover immediately. If you’re in a vehicle, trailer, or mobile home, leave and head to the closest building if you have time.

If you’re in a house or building, go to an interior room, bathroom, or closet on the lowest level. Cover yourself with blankets, towels, or a mattress to stay safe from falling debris. Never open windows; it doesn’t help equalize pressure. But you should shut all your doors because that will help reduce the chance that your roof will blow off.

If you’re driving, don’t stop under bridges or overpasses. They don’t offer protection from tornadic winds or flying debris. If you can’t get to a building, lie flat and face down in the nearest ditch or depression. Cover your head with your hands.

Tornado watch in your area? Get ready.

Tune in to your local weather report to keep track of the tornado watch. Get ready to move to a safe space.

A tornado watch area is often large, covering counties, even states.

If you are under a tornado watch:

- Review your emergency plans.

- Bring in or secure outdoor objects that might blow around.

- Check supplies, such as batteries, flashlights, water, non-perishable food, and medicines.

- Identify your safe room.

Summing up: A tornado watch means get ready. A tornado warning means move quickly to safety.

Learn more

- Are you prepared for a tornado? Here’s how to protect your home

- What are some common facts about tornadoes? (video)

- For more insurance tips, visit our before the storm page.

- Division of Workers' Compensation tips: Tornado Safety (PDF) | Seguridad en caso de tornados (PDF)

March 28, 2025

Flooded home or car? What to do next.

If your home or car has flood damage, insurance could help you recover.

Some tips for property owners:

- Take photos or video of the damage as soon as it’s safe. Don’t throw away damaged items until you talk to your insurance adjuster.

- If your home floods, call your insurance company to file a claim as soon as possible. If you have a policy through the National Flood Insurance Program (NFIP), call 877-336-2627. NFIP policies require you to file a claim within 60 days. If you can’t find your insurer’s phone number, call the TDI Help Line at 800-252-3439.

- Most home and renters policies don’t cover flood damage, but there are exceptions. Even if you lack flood coverage, you still might need a denial from your insurance company to apply for disaster assistance if available.

You can also make an insurance claim if you have other damage. Most home policies cover damage from wind or falling tree limbs. They also might cover damage to fences and other structures on your property.

If your car floods:

- File an auto insurance claim if you have comprehensive coverage; it covers flood damage.

- Take photos or video of the damage. If it’s safe to do so, also take pictures of your car in the water.

- Talk to a mechanic before trying to dry out a car that got water inside. It may have hidden damage.

Have insurance questions? Call the TDI Help Line at 800-252-3439.

Learn more

- National Flood Insurance Program: How to file a claim

- Flooded cars: What to know about insurance claims and repairs

- When are water damage and mold covered by insurance?

- Can I make an insurance claim for additional living expenses?

- Steps to getting your home or car insurance claim paid

- How to avoid contracting scams

January 16, 2025

Another Texas freeze in forecast? Podcast has steps to protect your home.

Just saying “freeze” can make a Texan flinch.

But you can take steps to protect your home before temperatures drop.

For starters, wrap indoor pipes with insulation. Wrap your attic pipes first.

And when a freeze happens, you can run water through your indoor faucets – hot and cold – before you go to sleep. Or you can let faucets drip from the cold and hot taps. Be sure to follow your local government’s instructions, which may limit water use.

Hear more about prepping your home on “The Texas Insurance Podcast,” featuring David Yelovich, a Texas State Board of Plumbing Examiners board member. Our podcast closes with TDI advice on insurance and water-related damage.

January 15, 2025

Unknown fire hazards in your home

Most people know that stoves, ovens, and candles are dangerous and can start fires.

But there are other fire risks in your home that you might not have thought about:

- Dryers. Clean your lint filter before each use. Make sure the air exhaust vent pipe leads to the outside and is unblocked. Clean the lint out of your vent pipe every three months. There are tools available at local home improvement stores that allow you to do it yourself. Or, you can hire a professional or get your apartment’s maintenance to do this. You want clothes to be fire, not on fire.

- Kitchen appliances. Our kitchens have all sorts of gadgets, like air fryers, microwaves, and coffee makers. Plug your appliances into a wall outlet, never an extension cord. Place them where they won’t get bumped or knocked over.

- Lithium-ion batteries. Smartphones, laptops, hoverboards – so many devices in our homes now use lithium-ion batteries. Don’t overcharge your devices, and don’t place them on a pillow, bed, or couch while charging. Keep devices that use lithium-ion batteries at room temperature.

If there is a fire in your house, get out and stay out. Use your cell phone to call for help or ask a neighbor to call 911.

September 9, 2024

How to prepare for a hurricane or tropical storm

Hurricanes and tropical systems can bring strong winds and rain. Here’s how you can prepare:

1. Invest in a weather radio

Have a way to get updates if cell services or power lines go down. Many weather radios now work as backup power banks with ports to plug in your phone and with solar and crank handles to recharge the battery.

2. Add your agent to your phone contacts

Put your agent and insurance company in the contact list on your phone. Make copies of important documents, such as your policy’s declaration page and auto and health ID cards and email them to yourself so you can get to them if you have to evacuate.

3. Prepare your home

- Remove dead tree limbs and branches that hang over your house.

- Check for items that can become windborne, such as yard furniture or trampolines, and tie them down or bring them inside.

- Clean gutters to let the water drain faster.

- Close doors to keep your roof on.

- If you plan on using a generator if the power goes out, make sure you have enough fuel. If you haven’t used it in a while, make sure it starts.

4. Be ready to evacuate

- Pack a bag with your insurance policies, home inventory, health plan cards, medication, water, and food in case you need to leave your house.

- If you have pets, make sure you have their vaccination records, food, water, leash, collar, tags, and crate.

- Keep your gas tank full.

- Plan an evacuation and a backup evacuation route.

- Let family members know where you’ll meet if you need to evacuate.

5. Listen to the news

Follow any evacuation orders from your local government.

Learn more

- How to prepare for a hurricane (video)

- Before the storm

- Home inventory (video)

- How to safely use a portable generator (video)

- How to prepare for hurricane season (video)

- Texas Division of Emergency Management (TDEM) Disaster information page

March 14, 2024

Any place can flood. Do you have flood insurance?

It can rain and flood anywhere. And most home insurance policies don’t cover flood damage. You might want to buy flood insurance.

One inch of water in a home or apartment can cause up to $26,000 in damage.

To shop for coverage, talk to your insurance provider. If they don’t offer a flood policy, go online to floodsmart.gov to find providers.

A flood policy takes effect 30 days after purchase. It’s wise to shop before hurricane season, which begins June 1.

Get expert advice on flood insurance in this Texas Insurance Podcast.

Learn more

- Flood insurance: Why you need a policy

- You live in a flood plain

- Hurricane season: How to prepare your home and property

August 3, 2023

Coastal Texans can turn to TWIA for hail, windstorm coverage

In August 1970, Hurricane Celia slammed ashore at Corpus Christi, killing and injuring residents and leaving previously unheard-of hundreds of millions of dollars in damage.

In response to insurance companies increasing rates or no longer selling wind and hail coverage along the Gulf Coast, state lawmakers in 1971 launched the Texas Windstorm Insurance Association (TWIA).

TWIA continues to serve as the wind and hail insurer of last resort for property owners in Texas’ 14 coastal counties and parts of Harris County. TWIA currently backs more than 237,000 policies.

If you live in a coastal community, read your homeowners policy to see if it covers hail and wind damage. If not, contact your insurance agent to see what options you have for coverage.

Eric Casas, TWIA ombudsman at the Texas Department of Insurance, cautions against assuming you can go without wind or hail coverage just because your home hasn’t been hit by a terrible storm. And if you have a mortgage, your lender will likely require you to have windstorm coverage.

Hear more tips about protecting your home from hail and wind damage in this episode of the Texas Insurance Podcast.

Learn more

- What is windstorm insurance?

- Texas Windstorm Insurance Association

- Homeowners, flood, and wind and hail policies: Know how they work

- What you need to know about windstorm inspections

May 2, 2023

Plan to be safe before a hurricane hits Texas

The Texas Division of Emergency Management (TDEM) regularly leads the state’s response to natural disasters including summer storms and hurricanes.

It also wants Texans to plan ahead to stay safe.

For instance, it’s a good idea to keep emergency “go kits”— basic disaster supplies including food, water, medicine, clothes, and other vital items — in your home, office, and car.

Also wise: Settle with family members ahead of time where you’re going to go if a bad storm hits. And if you think you might need flood insurance, shop before you hear a scary weather forecast. It takes 30 days for a flood policy to take effect.

View podcast Q&A: How to prepare for hurricane season

Learn more

- Hurricane season: How to prepare your home and property

- Flood insurance: Why you need a policy

- Before the storm

- Texas Ready disaster supply checklist

April 6, 2023

Prepare your home and family for spring Texas storms

A spring hurricane is unlikely. The latest one, Hurricane Alma, fizzled out near Cuba in May 1970.

Still, spring rains, hail, wind and even tornadoes can threaten homes, cars, and lives.

Some storm preparation tips:

- Paul Yura of the National Weather Service suggests you keep three days of food, water and other supplies, including pet food, on hand.

- Also, Yura says, decide well ahead of time where your family will go if dangerous weather approaches.

- Count on weather alerts on your cell phone. But, Yura says, also keep a weather radio handy, with fresh batteries. Sometimes the phone runs out of juice.

View podcast Q&A: How to prepare for spring storms

Learn more

- Texas summer storm safety

- 5 tips for driving in windy conditions

- Are you ready for a disaster?

- Tips to avoid a tornado: Follow weather reports

Insurance tips and help

How to get help or file a complaint: We can answer insurance questions, help with problems, and explain how to file a complaint against an insurance company or agent.

Videos: Our video library has short tips and interviews with experts on dozens of topics.

Insurance tips: Use our tips to get the best deal on insurance, protect yourself from fraud, and learn what to do when you have a problem.