April 3, 2024

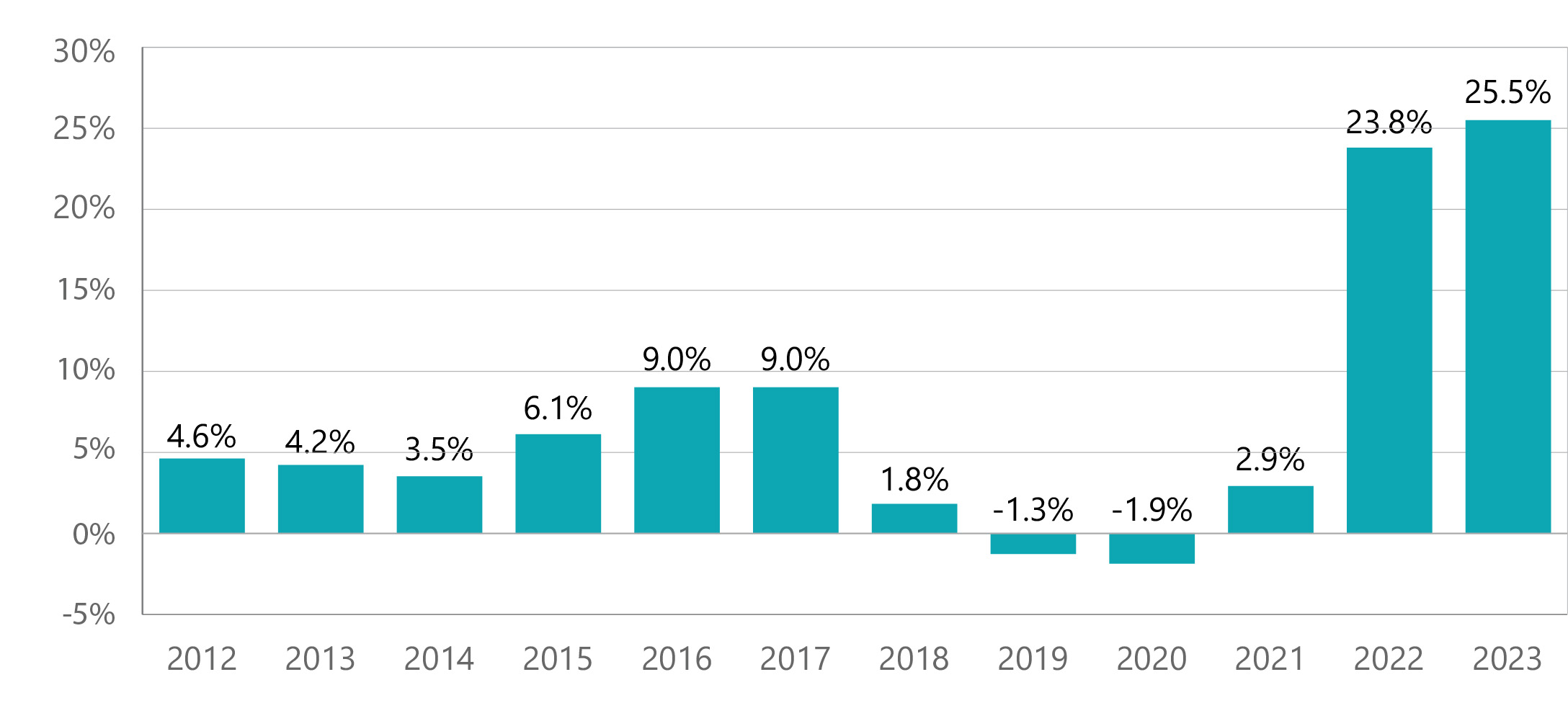

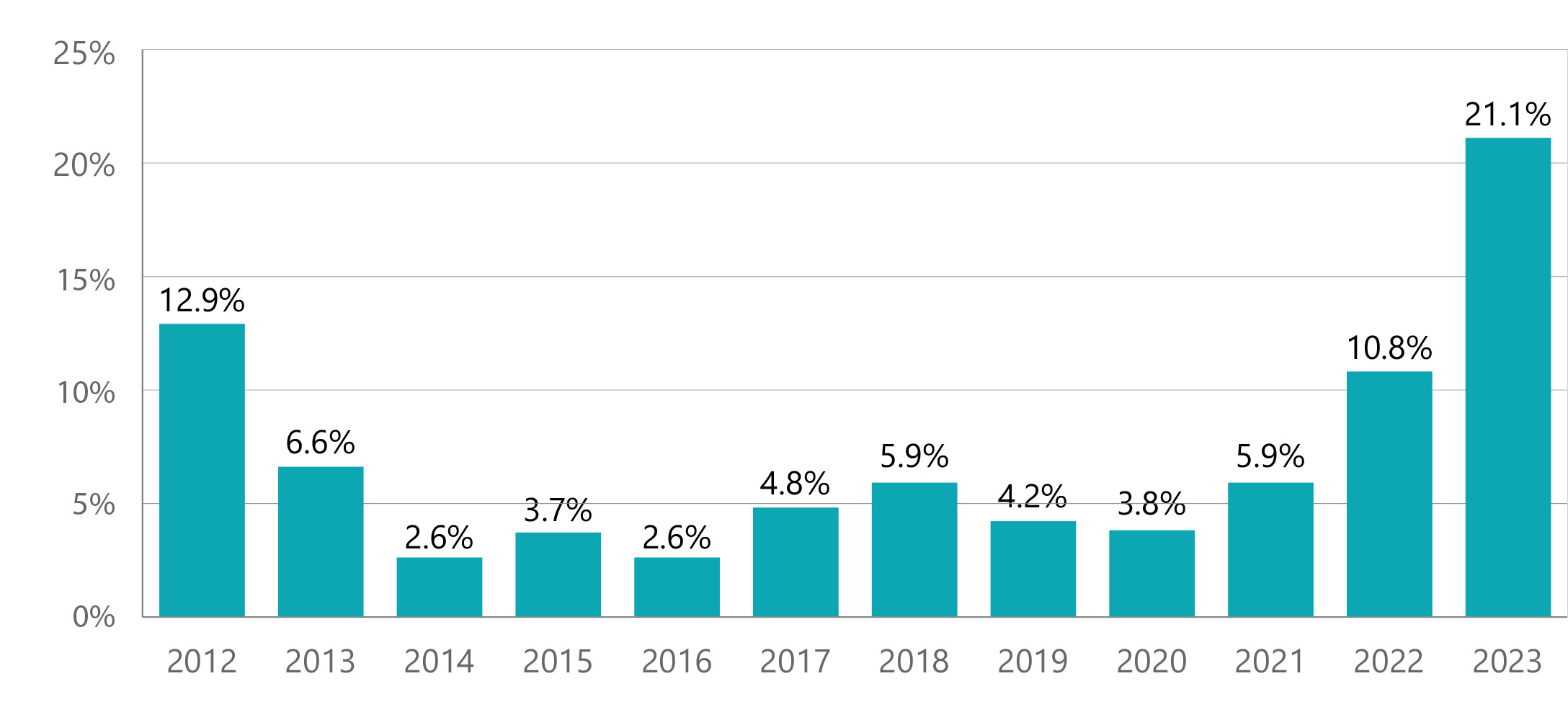

Auto and home insurance rate changes

Your premiums for auto and home insurance are likely different every year. This shows how much insurance companies have changed their rates on average across the state.

Private passenger auto average rate change

Source: TDI rate filing data

Homeowners average rate change

Source: TDI rate filing data

Note: includes rate changes for owner-occupied homeowners, tenants, condos, and mobile homeowners policies.

What’s the difference between a premium and a rate?

Premium – The amount you pay to an insurance company for an insurance policy.

Rate – The cost of insurance per exposure unit ($1,000 of home coverage or one year of auto coverage).

Example – A gallon of gas costs $3.50. I pay $49 to fill up my car’s 14-gallon gas tank. The premium is $49. It’s the rate ($3.50) times the unit (14 gallons).

Learn more

How are your auto and homeowners insurance costs calculated?

March 26, 2024

Insurance tips for new graduates

If you’re graduating and moving into your own house or apartment, there’s a lot to consider. Here’s what you need to know about insurance.

Protect your stuff: Renters insurance pays for your clothes, furniture, electronics, and other belongings if they’re stolen or damaged by a fire or other cause. Most renters policies also pay for your belongings if they’re stolen from your car.

Shop for auto insurance: If you need your own auto insurance, use TDI’s HelpInsure.com to compare rates and policies. Then ask several companies for quotes. Also ask if you qualify for any discounts.

Finding health insurance: If you have a job that offers health insurance, that’s great. Be sure to ask if your doctors are in its network to avoid a big bill. Also look at the plan’s website to find hospitals and urgent care centers near you for when you need a doctor after hours.

Learn more

- Renters insurance: What does it cover and how much does it cost?

- 10 steps to find the right auto insurance

- Need health insurance? How to find a new health plan now.

March 4, 2024

Do you need insurance experience to work for TDI? No.

True or false? You must have an insurance background to work for the Texas Department of Insurance.

False!

TDI has wide-ranging job opportunities. Recent job openings include those for attorney, investigator, actuary, auditor, programming, and accounting positions.

Sign up to get emails of TDI job postings

Isela Mata of TDI’s Human Resources office talks about why Texans of all stripes should consider working for the department in our video, A variety of job opportunities available.

Learn more

Thinking about a new job? Don’t forget the insurance.

February 29, 2024

Texas wildfires: Insurance can cover home, auto damages.

Your insurance can apply if a wildfire damages or destroys your home or car.

Some insurance tips:

- Homeowners insurance will pay to repair or replace your home or property if it is damaged or destroyed in a fire or storm, up to the policy limits. You’ll have to pay your deductible. Damage from an explosion or smoke also is typically covered.

- If you can't stay in your home because of damage covered by your policy, your homeowners or renters policy may pay for a hotel or rental. Check your policy for limits on the coverage.

- Your car is covered if you have comprehensive coverage. Some policies will pay for a rental car if yours is damaged.

- Call your agent or read your policy to check details.

Questions? Call the Texas Department of Insurance’s Help Line at 800-252-3439, 8 a.m. to 5 p.m. Monday to Friday.

Learn more

- Steps to getting your home or car insurance claim paid

- Recovery tips

- Working with an insurance adjuster

- How to avoid contracting scams

February 8, 2024

How to file your insurance claim

Need to make an auto or home insurance claim?

Tips to help you succeed:

- After a car accident or incident at your home, talk to your insurance company. You’ll want to discuss your options. Maybe you don’t want to file a claim. Consider your deductible—how much you pay before your insurance pays.

- If you make a claim, write down details including when you called the company, who you talked to, and your adjuster’s name. Also, make a list of documents or information the company wants from you.

- After a car accident, move your car to a safe location. Take photos of the accident scene, including your car, other involved cars, and anything that’s been hit such as trees, buildings, or street signs. Also photograph the other driver’s insurance information, driver’s license, and license plate.

- If your house is damaged, write down the time and date you first saw the damage. Also note what the weather was like at the time. Take photos of any damage. Protect your home from further damage by covering broken windows or putting a tarp over a roof hole. Don’t make permanent repairs until your company gives the OK.

- On any claim, save all receipts.

.

Want more tips about making a claim? Listen to this Texas Insurance Podcast.

Learn more

- Tips for filing a claim with your insurance company

- Were you in a wreck? Tips for auto insurance claims

- Steps to getting your home or car insurance claim paid

January 30, 2024

Will your auto insurance pay after a hit-and-run crash?

Every 43 seconds someone in the U.S. is involved in a hit-and-run accident. We hope it never happens to you, but statistics show it’s something that unfortunately happens a lot. So, what can you do?

Make sure you have the right auto coverage to repair your car.

In Texas, the law requires you to have liability insurance, but that won’t pay to repair your car after an accident. Liability insurance only pays to repair the other person’s car if you’re at fault in an accident.

To get your car repaired, you’ll need a car insurance policy with collision coverage or uninsured/underinsured motorist (UM/UIM) property damage coverage. Both pay for car repairs after a hit-and-run accident. UM/UIM coverage usually has a lower deductible than collision coverage and may pay for a rental car if you need it.

If you don’t have collision or UM/UIM coverage, consider asking your agent how much they would cost to add to your policy. Read about other coverages you might need in our Auto insurance guide.

Also read: Were you in a wreck? Tips for auto insurance claims

January 11, 2024

Shopping and saving on Texas auto insurance

Your auto insurance is up for renewal and you want to lower your costs.

Here are some ways to reduce your premium:

- Seek discounts. You may be missing available discounts. Ask your insurance company about discounts for having a student driver with good grades—or for drivers in your family being accident free. Discounts can also apply if you’re insuring your home with the same company.

- Choose a higher deductible. You could reduce your premium by paying a higher deductible if you need to make a claim. Keep in mind this kind of price cut up front could mean you have to pay more out of pocket if you get into a wreck.

- Review your coverage. The various coverages in your policy add up to your total premium.

If you have collision coverage on an old car that's paid off, make sure the car’s value is worth more than what you’re paying for that coverage. And tell your insurance company if you’re working from home and no longer driving to work. They might offer a pay-per-mile policy that would save you money.

Hear more about shopping for auto insurance in the latest Texas Insurance Podcast.

Learn more

- How are your auto and homeowners insurance costs calculated?

- Lower your car insurance rates: Tips for saving money

- How you drive could save you money on car insurance

- Ask for discounts to lower your auto insurance premium amount

- What to know about deductibles

May 8, 2023

Protect against other drivers with uninsured motorist coverage

Texas law requires drivers to have liability coverage on their vehicles.

But some drivers fail to get coverage. Warning sign: More than 2.6 million state-registered vehicles are not matched to an insurance policy. That’s 12% of the state’s registered vehicles.

So, it could pay for you to consider uninsured/underinsured motorist coverage, which insurance companies must offer when you buy auto insurance. If you don’t want it, you have to turn it down in writing.

If you add uninsured/underinsured coverage, you’ll have extra financial protection after an accident involving a driver with little or no insurance. The coverage pays your car repair and medical bills. You’ll have to pay a $250 deductible for car repair.

Related tips:

- Uninsured/underinsured coverage also pays to replace the property in your car, a rental car if you need it, your medical bills, and pain and suffering costs. If you don’t have this coverage, your collision coverage will pay to repair your car. But you won’t get these extra coverages and your deductible will likely be higher.

- If an accident leaves you with long-term care needs or you aren’t able to work, your health plan probably won’t cover those costs.

- Uninsured/underinsured motorist coverage pays if you’re in a hit-and-run accident and the other driver can’t be found to pay for damage.

- You can usually add uninsured/underinsured coverage in $5,000 increments. A rule of thumb is to add at least enough property damage coverage to replace your vehicle. Ask your agent what coverage works for you.

Learn more

- What is uninsured motorist coverage, and do I really need it?

- Were you in a wreck? Tips for auto insurance claims

- Will your auto insurance pay after a hit-and-run crash?

April 4, 2023

Distracted drivers are dangerous. How not to be one.

Don’t you hate distracted drivers?

You know—the driver sending a text message, fiddling with the car’s radio, or eating while driving.

Distracted drivers are dangerous. The Texas Department of Transportation (TxDOT) notes that in 2021, a distracted driver caused one in five car crashes on Texas roads.

To avoid distraction behind the wheel, remember:

- Texting while driving is illegal in Texas.

- Power off your phone and other electronics until you reach your destination. If you must communicate on the move, first pull over to park safely.

- If a driver acts out of line, stay calm. Don’t respond in kind. Keep your distance and let that driver scoot.

- If you think another driver is a danger, pull over in a safe place and call 3-1-1.

January 30, 2023

Even experienced drivers need reminders about driving in winter weather

Bad weather and sloppy roads cause nearly a half a million auto accidents and more than 2,000 deaths each winter according to AAA.

Don’t feel helpless on your drive and prepare for bad road conditions. Here are some winter weather driving safety tips:

- Keep cold weather items like ice scrapers, blankets, gloves, and layered clothing in your vehicle.

- Maintain an emergency kit for your vehicle with a cell phone charger, flashlight, battery-operated radio, and jumper cables.

- Inflate your tires correctly and make sure there is tread.

- Check to see if your battery is in good shape.

- Never warm up your vehicle in an enclosed area like a garage or place with poor ventilation. This will put you at risk of carbon monoxide poisoning and death.

- Avoid using cruise control in slippery road conditions.

In TDI’s Texas Insurance podcast, we talk to Sonja Gross from the Texas Department of Transportation about what Texans should know before driving in winter weather.

Before starting a trip, visit DriveTexas.org to see if roads are closed due to weather conditions.

Listen to our podcast for winter safety driving tips.

September 19, 2022

Am I covered by insurance when I rent a scooter?

Before you rent or jump on one of those cute zippy scooters, remember these tips.

- Scooter rental companies don’t cover you in case of accident or injury. Rental agreements give you all liability. That means you could be paying for any damages and injuries, not just your own.

- Home policies usually don’t cover damage from motorized vehicles and your auto policy probably won’t extend to an electric scooter.

- Don’t forget to read your scooter rental agreement before you ride. And to be safe, wear a helmet.

So, what covers scooter accidents? Your health insurance probably will cover your injuries—though it won’t cover anyone in your path.

Learn more

- Electric scooter insurance: What to know before you hop on

- Does insurance cover ATVs and golf carts?

- Do I need insurance for a motorcycle or moped?

August 4, 2022

Safety and savings tips when you go back to college

Many college students live off campus.

Freedom, right?

But you need to watch out for yourself.

Some money-saving and safety tips:

- Call your health plan to find nearby urgent care centers that are in your plan’s network. This could save you money when you need care.

- Look for the fire alarms and exits in your apartment complex. Some alarms sound a bell. Others have a voice feature telling you where to go if there’s a fire.

- Consider renters insurance. At less than $200 a year, a renters policy can pay to replace your things after a fire or other disaster. It might also pay for you to live somewhere else while repairs are being made.

- Let your auto insurance agent know that you’re back at school. This might save you money.

Hear more expert advice about going back to school in the latest Texas Insurance Podcast.

View podcast Q&A: How college students can stay healthy, safe, and protect their stuff

Learn more

- Renters insurance: What does it cover and how much does it cost?

- Insurance tips - college edition

- Back-to-school safety

May 5, 2022

Will your car’s rubber tires keep you safe from a lightning strike?

True or false: Your car’s rubber tires will protect you if lightning strikes your car.

False!

John Jensenius of the National Lightning Safety Council says it’s the type of car – not the tires – that protect you from lightning. You’re the safest in a hard-topped vehicle. When lightning hits, he says, the shock gets dispersed by your car’s metal shell and keeps the people inside safe.

Tire twist: If your car or truck has steel-belted tires, a lightning strike can blow them out.

Learn more from Jensenius about staying safe from lightning on the latest episode of the Texas Insurance Podcast.

View podcast Q&A: How to stay safe from lightning

Learn more

- Thunderstorms: How to protect yourself from lightning

- Texas town listed as the US lightning strike capital

April 7, 2022

Shop to save money on your car insurance

You probably shop for the best prices and quality when you’re looking for new clothes, tech products, and food.

But do you do that for car insurance?

Give it a try.

Quick tips to save on coverage:

- Shop around. Companies charge different rates. You often get a better deal if you’re willing to switch companies.

- Ask about available discounts—for a good driving record, for having an alarm in your car, or for taking defensive driving or driver education classes. You could also get a discount for having your auto policy with the same company as your home insurance.

- Your premium is what you pay up front for coverage. But don’t forget to check on your deductible—what you must pay after an accident before the insurance company pays. A lower deductible usually means you’ll have to pay more up front for the policy. Think about how much you can afford to pony up if your car is damaged.

Hear more tips and learn what drives the cost of car insurance in the latest episode of “The Texas Insurance Podcast.”

View podcast Q&A: How to lower car insurance costs

Learn more

- Ask for discounts to lower your auto insurance premium

- How you drive could save you money on car insurance

- Shopping for auto insurance: What to know before you buy a policy

- Answers to your auto insurance questions (podcast)

February 24, 2022

Driving on slick streets? What to do if you’re in a wreck

If you must drive in dangerously icy or slick conditions, remember to proceed with caution.

And what if you’re in a wreck?

First, make sure that nobody is hurt.

After that, you’ll want to reach out to your auto insurance company. If you need help filing a claim, contact us at 800-252-3439.

Some tips about making your insurance claim after a wreck:

- Were you in a wreck? Tips for auto insurance claims

- My car was totaled! Now what?

- Or watch our video, “What should you do after a wreck?”

More: Will your auto insurance pay after a hit-and-run crash?

January 27, 2022

You could save money by comparing car insurance prices

People routinely price-shop food, clothes, tech products and other items. Yet in 2020, more than half of U.S. customers didn’t take any action to manage their auto insurance costs, according to a J.D. Power study released in 2021.

Customers who did act mostly chose to reduce coverage; increase their deductible; or shop or shift to a different provider, the study found.

Michele Thomas of TDI’s Property and Casualty Division suggests that car owners check coverage prices every two years or so—especially if you haven't had any tickets or accidents in some time.

Your price check should start with your current carrier. It might have discounts reducing your costs.

Watch our video, How to save on car insurance.

Learn more

- Ask for discounts to lower your auto insurance premium

- How you drive could save you money on car insurance

- Shopping for auto insurance: What to know before you buy a policy

- Answers to your auto insurance questions (podcast)

January 24, 2022

Don’t ‘puff’ your cold car or truck outdoors; keep thieves away

It’s tempting in cold weather to start your car or truck and then scoot indoors while it turns toasty. This is known as “puffing” because steam puffs out of the exhaust pipe while your ride warms up.

But beware. Thieves may see your unattended vehicle as a drive-away opportunity.

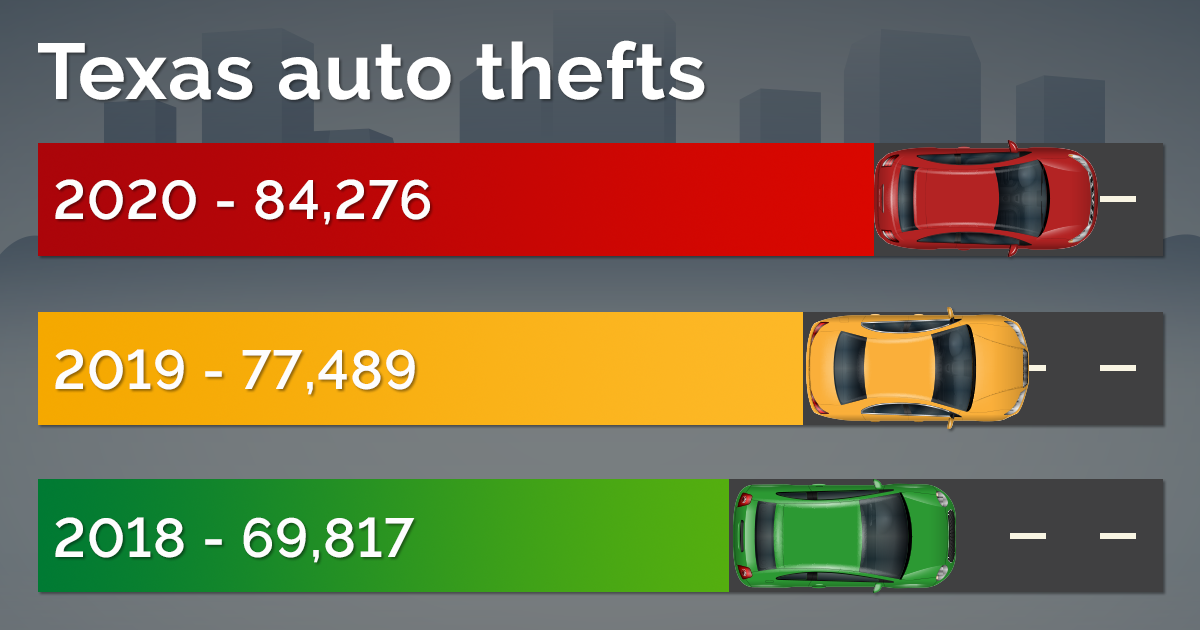

Over a recent three-year period, more than 17,000 Texas cars and trucks were stolen with keys or fobs left inside. And that count may be low because many drivers don’t admit to making the mistake. These incidents also aren’t noted in police reports or insurance claims, according to the National Insurance Crime Bureau.

Other tips to avoid break-ins and thefts

- Lock doors and windows as soon as you enter your vehicle.

- Park in well-lit areas.

- Use a loud alarm or an anti-theft device a thief can see.

- Install a catalytic converter cover or lock.

Learn more

- Auto theft and insurance: How to protect your ride

- Tips to avoid car break-ins (video)

- Car burglaries and break-ins are increasing. Here’s how to protect your car (podcast)

September 30, 2021

TDI answers your auto insurance questions

Not sure what kind of auto insurance you need? Wondering why your rates went up? In our latest podcast, TDI experts answer your top auto insurance questions.

Here are a few of the questions we hear the most.

- What should auto insurance cost, and what’s the best kind to get?

- Why do my neighbors pay less for auto insurance than I do?

- Should I buy the insurance car rental companies try to sell me?

- Should I get “gap coverage” when I buy a new car?

- Why do insurance rates in Texas seem higher than in other places?

- What can I do to keep costs down?

Listen to the podcast to get the answers and some money-saving tips.

August 5, 2021

Buying a used car? Here’s how to avoid scams

Buying a vehicle? Curious about the one you’ve got? Did you know you can check a car or truck’s vehicle identification number (VIN) number to learn more about it? The information you get with a VIN can help keep you safe and save you money.

For our latest podcast, we talked to the National Insurance Crime Bureau (NICB) about how a VIN can help you. And the Better Business Bureau (BBB) of Greater Houston shared how to avoid scams when you buy a vehicle online.

Some tips: You can use NICB’s VINCheck to find out if a vehicle was stolen or damaged. A VIN can also tell you if it was flooded during a hurricane. That’s important because, if it was, sensors for airbags and bumpers could fail in an accident.

It’s also a good idea to check with the Better Business Bureau in your area when you buy a used vehicle, especially if you buy online. The BBB can tell you if a seller or website has a lot of complaints or bad reviews. And they can tell you about the latest scams—like a price that’s too good to be true, or a third-party escrow site that seems fake.

If you’re in the market for a car or truck, listen to our podcast for more information.

June 2, 2021

Starting your financial future together

Getting married soon? You’re not the only happy couple! Wedding planners report being booked through the year as couples reschedule weddings postponed due to the pandemic. We can’t help you find a caterer, but we do have an insurance checklist to get you off to a good financial start.

Renters insurance: The average renters policy in Texas costs about $20 a month. That’s a great way to protect those nice wedding gifts. It will pay to replace items damaged by a burst pipe or other cause. It will also cover personal items stolen from your home or car.

Auto policies: Combining your auto policies may save you money. Most insurance companies offer a discount if you have more than one vehicle, and rates are usually lower if you’re married.

Health coverage: You have several options for health coverage. If both of you have coverage through work, compare the policies. One may have better benefits, a lower deductible, or a lower cost to add a dependent. And check to see if there’s a deadline to add a spouse.

Life insurance: As your situation changes and your family grows, you may need life insurance. Consider how much income would need to be replaced to help with childcare, your mortgage, and other debts.

May 5, 2021

Used car prices are up, so shop smart

Cars are the latest shortage of the pandemic. A lack of computer chips is slowing production of new cars and trucks, and it’s increasing demand for used vehicles. It’s a great time to sell, but expect to pay more if you’re buying. Average trade-in values hit a record $17,080 in March, up 20% from a year ago, according to the car research website Edmunds.

While you may have to pay more, make sure you’re not getting scammed. Before you buy a used car, check the vehicle identification number (VIN). It will confirm the vehicle’s model year and let you know if it’s been reported stolen or salvaged.

The National Insurance Crime Bureau offers a free VIN check and has links to other services.

For more information about VINs and the information you can get with them, watch our interview with Tully Lehman, an expert at the National Insurance Crime Bureau.

April 19, 2021

New podcast looks at increase in auto thefts

Auto thefts were up in Texas and across the nation last year. In our new podcast, we talk to Sgt. Tracy Hicks with the Houston Police Department’s Auto Theft Crimes Task Force about what you can do to protect your car or truck from burglaries and theft.

Thieves often break into cars to look for guns, Sgt. Hicks said. Be especially careful when going to a gun range or store because thieves may be watching the parking lots to identify potential targets. He suggested getting a car safe if you carry guns or other valuables in your car.

Catalytic converters are another hot commodity for thieves, who sell the precious metals inside. Catalytic converters easy to steal and hard to identify. Hybrid cars are often targeted because their catalytic converters – and the metals inside – are usually cleaner than on gas cars. You can get a catalytic converter lock or cover installed to make it harder to remove.

Check out our podcast for more about the latest trends in auto theft and how to protect your car or truck.

We have also a video interview with Sgt. Hicks and information about insurance coverage for auto thefts and burglaries.

Insurance tips and help

How to get help or file a complaint: We can answer insurance questions, help with problems, and explain how to file a complaint against an insurance company or agent.

Videos: Our video library has short tips and interviews with experts on dozens of topics.

Insurance tips: Use our tips to get the best deal on insurance, protect yourself from fraud, and learn what to do when you have a problem.