Best practices

Mediocrity and excellent service don’t mix. As we evaluated our programs and processes, we did a comprehensive review of industry leaders and best practices across the public and private sectors. Here are examples of how we took those lessons and applied them to our own programs.

Designed a complaint process to keep up with demand

Faster complaint resolution

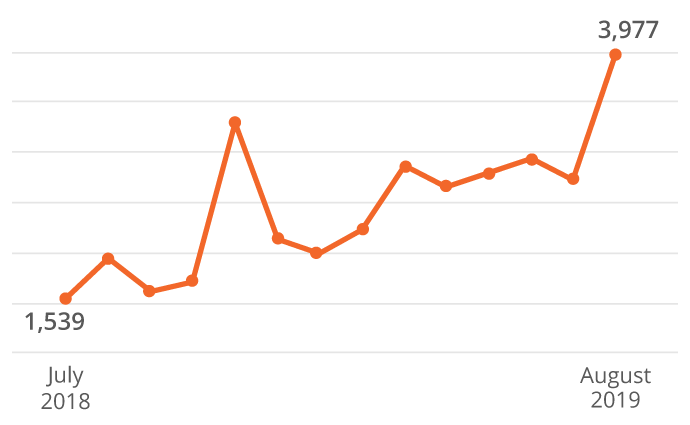

TDI continues to make progress to speed processing of complaints. The reorganization of that area in late 2018 and other improvements allowed us to double the number of cases we can resolve each month.

Cases completed

Improving complaint processing is a priority for the agency. TDI’s technology and processes had remained essentially unchanged over years as the number of complaints increased. The result: A backlog first developed in 2015 and continued to grow as the gap between the number of complaints received and the number resolved widened.

The complaint process has now undergone a comprehensive makeover:

- We modernized business operations and emphasized processing center best practices.

- We eliminated a backlog for balance billing mediation requests by improving automation.

- More staff were assigned to process complaints about health claims, which make up about 75% of all complaints.

- Online improvements made it easier for consumers to submit complaints and check their status.

Improved continuity of leadership and organizational structure

TDI now has a clear second-in-command with the creation of a chief deputy commissioner position in 2018. This was long overdue for an agency with 1,300 employees and a $110 million annual budget. The change creates more oversight and consistency of division operations and decision making. Other important organizational changes included:

- A separate Life and Health Division was created to focus exclusively on the complex issues facing health insurance.

- Call center and processing operations were combined in a single division. Using similar processes and technology for similar functions facilitates best practices and allows the agency to make the most of technology upgrades.

- The Legal Section moved under the General Counsel Division to reflect a more traditional legal structure and create a streamlined decision-making process.

Standardized processes and templates

We increased consistency and efficiency by developing standard processes and templates for repeatable events across the agency. Some examples of that effort include:

- We worked with the industry to develop a standard data call so insurers know what information they’ll need to report ahead of the next disaster. This will allow TDI to collect data and analyze how the industry responded faster after disasters.

- We created templates for the most common bulletins issued immediately after a disaster. This allows the agency to quickly provide guidance to the insurance industry after major storms.

- New contract templates have resulted in a faster, more consistent process.

Invested in workforce development

We increased our focus on training to ensure our staff have the skills to help us modernize and evolve.

- Technology training included in-depth mentoring on new technology and helping employees better use existing tools, such as Sircon.

- Staff attended trainings for business analysis, best practices for cybersecurity, best practices for recruiting, and process optimization.

- A dozen plain language trainings featuring state and local experts helped improve how we communicate. Trainings ranged from an intensive full-day workshop for writers and editors to sessions just for call center employees.

- Our web team now has advanced certifications in usability, which emphasizes the overall online user experience.

Streamlined rule development

We reviewed our rule development process to allow for more concurrent internal reviews and automate the approval process. With the former process, it could take years to adopt rules for legislative changes. Under the new process, the agency published proposed rules for Senate Bill 1264, a comprehensive piece of legislation about medical balance billing, in 3 months.

Other improvements include:

- Reorganized TDI’s Fraud Unit to focus on two priorities: consumer protection and large-scale claim fraud to make the best use of state resources.

- Embedded fraud investigators with FBI financial crime task forces in Austin and McAllen. The relationship gives TDI investigators access to FBI resources. The Fraud Unit also expanded its fraud prosecutor program into Travis County. We now have agreements with five district attorneys’ offices across the state.

- Pressed for improvements at the Hobby Building in Austin, including refurbished elevators, enhanced security, lobby and plaza improvements, and better pest control and cleaning services. We also added Wi-Fi bandwidth at Hobby and field offices. These changes have improved employee efficiency and morale.

- Reduced the number of filings property and casualty insurers must submit. The change means less duplication and improved efficiency for staff reviewing filings.

- Added a shared services team that can suggest improvements based on a broader view of agency operations and processes than frontline employees have.

- Strengthened IT security by requiring multi-factor authentication to log into computer systems. Undercover testing now helps identify and correct data security weaknesses.

- Achieved a 25% increase in completed financial examinations. We did this by improving how we schedule examinations and leveraging work of other TDI programs, state regulators, and independent and internal insurer auditors. Overall, these changes reduce the cost of regulation without reducing the effectiveness of TDI oversight.

- Created a call center user group that lets TDI, Division of Workers’ Compensation, and Office of Injured Employee Counsel employees collaborate and share best practices.

- Overhauled the agency program that handles data privacy incidents. This included facilitating communication, decision-making, and appropriate responses to suspected compromises of agency systems and information.

- Coordinated with the Texas Health and Human Services Commission to streamline network adequacy reviews and with the Division of Workers’ Compensation on utilization reviews to eliminate duplication of effort and improve our efficiency.