This bulletin replaces Commissioner's Bulletin # B-0002-18, of February 1, 2018. Paragraph 19 of this bulletin links to a document from the Texas Comptroller of Public Accounts, which addresses insurer questions on premium taxes.

On February 1, 2018, the Commissioner of Insurance concurred with the request from the Texas FAIR Plan Association (FAIR Plan) to assess participating insurers for FAIR Plan’s 2016 deficit of $15.2 million. The Commissioner will consider whether to direct FAIR Plan to assess for its 2017 deficit after FAIR Plan files its year-end financials with TDI.

We have received numerous questions related to the assessment and recoupment. This is the first time FAIR Plan has assessed its members, and because of this unique situation, we are providing these answers to facilitate compliance and consistent application of surcharges.

TDI does not provide legal opinions and encourages insurers to consult their own attorneys.

Assessments

- When must an insurer pay FAIR Plan’s assessment?

An insurer must pay FAIR Plan within 30 days after receiving notice of the assessment. 28 Tex. Admin. Code § 5.9923(g).

- What happens if an insurer does not timely pay its assessment?

FAIR Plan must report to TDI every insurer that has not paid its assessment within 40 days. The Commissioner must immediately take action to suspend or revoke the certificate of authority of each insurer that has not paid its assessment until FAIR Plan certifies the insurer’s assessment is paid in full. 28 Tex. Admin. Code § 5.9923(g).

- How is an insurer’s assessment calculated?

Insurance Code § 2211.101(b) explains how to calculate an insurer’s participation in FAIR Plan. These calculations differ from those an insurer uses to determine the uniform percentage for surcharges, if the insurer elects to recoup the assessments.

Recouping Assessments

- Must an insurer recoup its assessment?

No. An insurer may, but is not obligated to, recoup its assessment through a premium surcharge. Tex. Ins. Code § 2211.104(b); 28 Tex. Admin. Code § 5.9923(c).

- How may an insurer recoup an assessment?

An insurer may charge “a premium surcharge on every property insurance policy insuring property in this state that the insurer issues, the effective date of which is within the three-year period beginning on the 90th day after the date of the assessments . . . .” Tex. Ins. Code § 2211.104(b).

Section 2211.104 does not provide other options—such as policy fees or including an expense for ratemaking—for an insurer to reimburse itself for the assessment.

- What policies are subject to the surcharge?

An insurer may only surcharge property policies with effective dates within the specified three-year period—starting 90 days after the assessment and continuing for three years.

- May an insurer surcharge some but not all lines of property policies it writes?

No. If an insurer wants to recoup its assessment, it must do so by surcharging “every property insurance policy insuring property in this state that the insurer issues.” Tex. Ins. Code § 2211.104(b); 28 Tex. Admin. Code § 5.9923. The statute and rule do not allow an insurer to surcharge some of those policies but not others. Similarly, although insurers are members of FAIR Plan because they write residential coverage, the statute and rule do not limit the policies subject to surcharge to only residential property policies.

- Are there particular lines of insurance subject to recoupment surcharges, such as inland marine?

All property insurance policies, including farm and ranch insurance, farm and ranch owners insurance, flood, earthquake, wind and hail, and others, are subject to recoupment surcharges. Tex. Ins. Code § 2211.104. The Insurance Code lists lines of insurance to which general provisions for property and casualty rates and policy forms apply.

Inland marine insurance is not subject to recoupment surcharges. Sections 2251.003(b) and 2301.003(b) distinguish between “inland marine insurance” and “residential and commercial property insurance, including farm and ranch insurance and farm and ranch owners insurance.” Tex. Ins. Code §§ 2251.003(b)(2), 2251.003(b)(11), 2301.003(b)(2), and 2301.003(b)(11).

- Are combined policies subject to surcharge?

Policies that combine the coverages listed in Insurance Code § 2251.002(1) and § 2301.002(1) are considered commercial property insurance policies and are subject to recoupment surcharge.

- How are surcharges calculated?

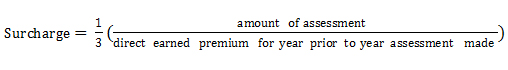

An insurer that elects to recoup its assessment must calculate surcharges as “a uniform percentage of the premium on such policies.” 28 Tex. Admin. Code § 5.9923(c). An insurer is entitled to recoup one-third of the ratio of its assessment to the amount of its direct earned premiums for the calendar year immediately preceding the year the assessment is made, each year for three years “so that, over the three-year period, the aggregate of all surcharges by the insurer . . . is at least equal to the amount of the assessment . . . .” Tex. Ins. Code § 2211.104(c); 28 Tex. Admin. Code § 5.9923(c).

For assessments made in 2018, an insurer must use its 2017 direct earned premium as reported in its financial statements to calculate its uniform percentage for the surcharge.

Calculations for an insurer’s participation in FAIR Plan differ from those an insurer uses to determine the uniform percentage for surcharge, if the insurer elects to recoup the assessment. Tex. Ins. Code § 2211.101(b) and § 2211.104(c).

- May an insurer round surcharges to the nearest dollar?

An insurer may round surcharges to the nearest dollar (50 cents and higher rounded up to next dollar and 49 cents or less rounded down). The minimum surcharge may be one dollar. 28 Tex. Admin. Code § 5.9923(c).

- Over what period of time may an insurer surcharge policies?

An insurer that surcharges policies may only do so during the three-year period that begins 90 days after the assessment. Tex. Ins. Code § 2211.104; 28 Tex. Admin. Code § 5.9923.

There is no authority for surcharging a policy with an effective date outside the prescribed three-year period, which begins 90 days after the date of assessment.

- What if an insurer is not ready to surcharge policies with effective dates at the beginning of the three-year period?

An insurer is not required to begin surcharging immediately at the beginning of the three-year period. However, because an insurer must calculate a uniform percentage to apply to policies subject to surcharge, an insurer that starts surcharging late may not be able to recoup the full amount it otherwise could during the first year of the three-year recoupment period. This may cause the insurer to under-collect.

An insurer may not extend the three-year period for surcharges, impose other fees or surcharges, or increase its uniform percentage in future years for under-collection in the first year.

- May an insurer stop collecting before the end of the three-year period?

Yes. An insurer is not required to recoup its entire assessment. An insurer may wish to stop early to avoid over-collection.

- If FAIR Plan assesses an insurer more than once, may an insurer combine multiple surcharges into one charge on a policy?

Yes, but an insurer may only combine surcharges on policies that are subject to both surcharges. In other words, where the three-year periods overlap, an insurer may combine the surcharges.

- May an insurer collect surcharges in excess of its assessment?

Insurance Code § 2211.104(c) contemplates that an insurer might over-collect. It directs insurers to compute the surcharge amount so the aggregate of all surcharges “is at least equal to the amount of the assessment" (emphasis added).

Insurers may stop collecting the surcharge before the end of the three-year period to minimize over-collection.

- Must an insurer refund surcharges in the event of mid-term cancellations or policy changes?

Insurance Code § 2211.104 does not specifically require refunds in the event of mid-term cancellations or policy changes.

- What if an insurer does not collect sufficient surcharges to recoup its assessment?

An insurer that elects to recoup but does not collect surcharges equal to its assessment during the specified three-year period may not extend the period to collect surcharges, impose other fees or additional surcharges, or increase its uniform percentage in future years for under-collections in prior years to recoup its assessment.

- Must an insurer give notice to policyholders of surcharges, and, if so, how? Are there requirements for how an insurer should list the surcharge on declarations and billing?

There are no specific notice, billing, or declarations page requirements for FAIR Plan recoupment surcharges. Insurers may have an interest in letting policyholders know the source of additional charges. If an insurer amends its residential property declarations page form to include information about the surcharge, the insurer must file that form with TDI for approval. 28 Tex. Admin. Code § 5.9323.

However, Insurance Code § 550.002 specifies that insurers receiving automatic premium payments through withdrawal of funds from a person’s account may not increase the amount of funds to be withdrawn unless the insurer gives notice of the increase not later than 30 days before the effective date of the increase. This notice is not required if the increase is less than $10 or 10 percent.

- How must an insurer report surcharges it collects?

Existing statutory accounting requirements provide guidance on how to reflect and report assessments and surcharges related to assessments in financial statements. See Statement of Statutory Accounting Principles No. 35R (Guaranty Fund and Other Assessments); NAIC Annual and Quarterly Statement Instructions.

- Are there any required rate or form filings associated with surcharges?

An insurer already must file information about surcharges in its rate filings. Tex. Ins. Code § 2251.101; 28 Tex. Admin. Code § 5.9334(b). These sections require that an insurer must file all rates, supplementary rating information, fees, and additional information as required by statute. The definition of fees includes amounts other than premium collected by the insurer in connection with a policy. 28 Tex. Admin. Code § 5.9331(b)(2).

No form filing is required unless an insurer revises or adds a policy form or endorsement. If an insurer amends its residential property declarations page form to include information about the surcharge, the insurer must file that form with TDI for approval. 28 Tex. Admin. Code § 5.9323.

- Are surcharges subject to commissions or premium taxes?

Commission arrangements are a matter of contract between insurers and agents. No statute or rule addresses whether insurers owe commissions on recoupment surcharges.

The Texas Comptroller of Public Accounts is responsible for determining whether surcharges are subject to taxation and has posted an FAQ on the topic.

For questions about this bulletin, email PropertyCasualty@tdi.texas.gov.