The following examples and information are provided to help employers complete the self-insurance renewal application.

- Example: Organizational structure chart

- Example: Company coverage list

- DART rate information

- Claim experience

- Contact information

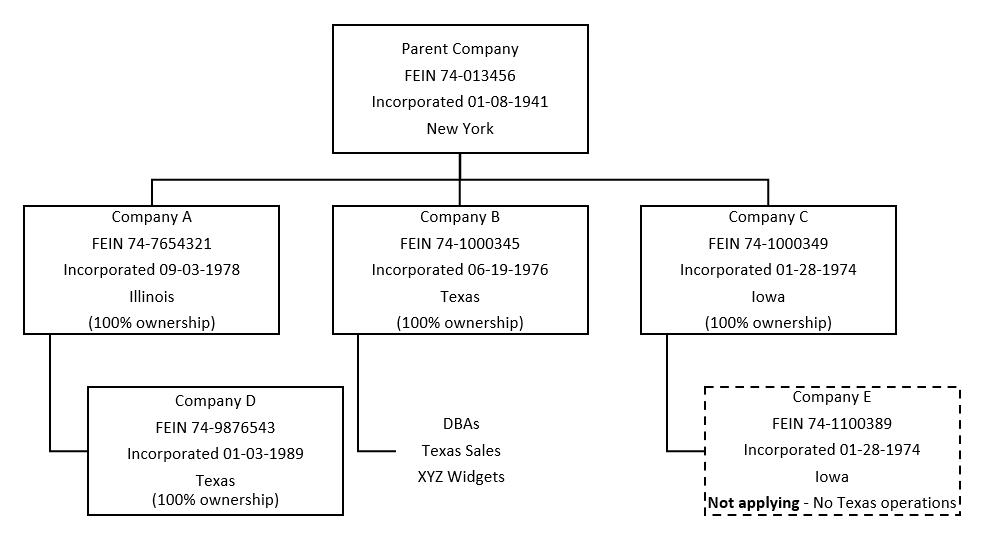

Example – Organizational structure chart

Example – Company coverage list

Note: If subsidiaries are added or dropped from coverage, use the “Add to coverage date” column to show when subsidiaries were acquired or otherwise added to coverage and use the “Drop from coverage date” column to show when a subsidiary can be dropped from coverage.

| Corporate entity | FEIN | NAICS code & description | Current active number of employees | Add to coverage date | Drop from coverage date |

|---|---|---|---|---|---|

| Parent company | 12-3456789 | 332312 – Fabricated structural metal mfg. | 453 | ||

| Company A | 23-4567890 | 332611 – Spring (heavy gauge) mfg. | 330 | mm/dd/yy | |

| Company B, Dba Texas Sales, Dba XYZ Widgets |

45-6789012 | 332312 – Fabricated structural metal mfg. | 350 | ||

| Company C | 78-9012345 | 332321 –Metal window and door mfg. | 32 | mm/dd/yy | |

| Company D | 89-0123456 | 332618 – Other fabricated wire product mfg. | 279 | mm/dd/yy |

DART rate information

Days away, restricted duty, or job transferred (DART) case rate is an OSHA calculation that measures how safe a business has been in a calendar. An explanation is required if the employers’ DART rate is more than 50% higher than the year before, or than the most current Texas or national rates. The following table provides the most common NAICS codes of Texas certified self-insured employers along with their average injury and illness rates. See a full list. The U.S. Bureau of Labor Statistics publishes the national DART rates.

|

NAIC code |

Description |

Texas |

National |

|---|---|---|---|

|

237130 |

Power and communication line and related structures construction |

0.8 |

1.0 |

|

237310 |

Highway, street, and bridge construction |

1.2 |

1.6 |

|

311612 |

Meat processed from carcasses |

4.3 |

4.4 |

|

321219 |

Reconstituted wood product mfg. |

0.9 |

2.5 |

|

324110 |

Petroleum refineries |

0.1 |

0.3 |

|

326111 |

Plastics bag and pouch mfg. |

2.0 |

2.4 |

|

327993 |

Mineral wool mfg. |

1.6 |

1.1 |

|

332912 |

Fluid power valve and hose fitting mfg. |

1.1 |

1.2 |

|

336112 |

Light truck and utility vehicle mfg. |

2.0 |

4.5 |

|

336120 |

Heavy duty truck mfg. |

2.0 |

2.5 |

|

336411 |

Aircraft mfg. |

1.0 |

1.8 |

|

336414 |

Guided missile and space vehicle mfg. |

1.0 |

0.5 |

|

336510 |

Railroad rolling stock mfg. |

2.0 |

1.8 |

|

424410 |

General line grocery merchant wholesalers |

3.3 |

4.0 |

|

424990 |

Other miscellaneous nondurable goods merchant wholesalers |

1.0 |

1.3 |

|

444120 |

Paint and wallpaper stores |

2.9 |

2.9 |

|

444190 |

Other building material dealers |

2.9 |

2.5 |

|

481111 |

Scheduled passenger air transportation |

6.1 |

6.1 |

|

484121 |

General freight trucking, long distance, truckload |

2.2 |

2.7 |

|

484122 |

General freight trucking, long distance, less than truckload |

2.2 |

2.7 |

|

492110 |

Couriers and express delivery services |

6.8 |

7.9 |

|

561330 |

Professional employer organizations |

0.8 |

0.4 |

|

622110 |

General medical and surgical hospitals |

2.3 |

3.1 |

|

721110 |

Hotels (except casino hotels) and motels |

1.5 |

2.7 |

|

722515 |

Snack and nonalcoholic beverage bars |

1.0 |

1.1 |

Updated December 2023

Claim experience

The claims history table, loss run, and actuarial certification, described below, should all be valued as of the same date.

Claim history table – DWC provides a customized table to each employer for annual reporting on its experience to date. For each calendar year and in total, this table summarizes the information outlined below. The summary should only include Texas self-insured claims information unless more information is specifically requested.

The claim history table includes the following:

- Total claims – The number of claims occurring during the specified reporting period.

- Open claims – The number of claims that are open as of the valuation date.

- Fatalities – The number of compensable fatalities that occurred during the specified reporting period. If there is a new compensable fatality, please attach a summary to include the deceased employee’s name, the date of accident, a brief description of the source of the accident, and the current status of the claim. Also include information about any OSHA investigation or citations relating to the fatality.

- Medical & indemnity liabilities – Indemnity and medical losses for all claims, including paid to date and reserves.

- ALAE (allocated loss adjustment expense) – Generally, attorney’s fees and costs related to legal defense of claims, including paid to date and reserve.

- IBNR (incurred but not reported) – A reasonable estimate of losses for claims incurred that have not been reported to the applicant and loss development.

- Total ultimate liabilities – The total of “medical & indemnity liabilities”, ALAE, and IBNR.

- Total paid to date – The total of payments made on all claims as of the valuation date.

- Estimated future liabilities – Calculated by subtracting “total paid to date” from the “total ultimate liabilities”.

Loss run – Detailed loss runs should provide claim specific information for each Texas self-insured claim. The loss run submitted must support the information provided in the claim history table. Include all claims (both open and closed) and list separately the claimant’s name, date of accident, occupation, cause and nature of injury, and part of body affected. Include indemnity liabilities incurred, medical liabilities incurred, ALAE incurred, payments made to date, and estimated future liabilities by claim.

Actuarial certification – Information in the claim history summary must be signed and sworn to by a certified casualty actuary every three years.

Contact information

SIR needs the latest contact information for each self-insurer. This information is also made available to injured employees and the public.

Company contact – An employee of the applicant’s business will be the applicant’s primary liaison. All communications between the applicant and SIR, including security deposit transactions and invoicing of taxes and fees, will be directed to the company contact. Notify SIR in writing about any changes in the company contact information.

Third-party administrator (TPA)/Qualified claims servicing contractor – An employee of the designated claims administrator should be designated as the claims contractor’s liaison in specific matters relating to claims administration. Notify SIR in writing about any change in the claims servicing contractor or their contact information. While SIR recommends that all claims be transferred to the new administrator, if claims handling for legacy claims is not transferred, contacts for both administrators, along with the corresponding date of claims for each administer must be clarified.

Austin, Travis County representative – A designated person in Austin, Travis County, Texas who will be the applicant’s liaison with the DWC. This person acts as the certified self-insurer’s agent for receiving notices from DWC. This means that any notice from DWC, sent to the designated representative’s Austin address, is notice from DWC to the certified self-insurer. DWC must be notified in writing of any change in the Austin, Travis County representative using DWC Form-027.