Texas enacted the first workers’ compensation laws in 1913, and since then, has held fast to the principle that private-sector employers should be allowed to choose whether to offer workers’ compensation to their employees. Businesses that provide coverage are called “subscribers.” Those that do not are called “non-subscribers.”

The first study in Texas to estimate the percentage of employers that are “non-subscribers” to the Texas workers’ compensation system was done in 1993. This year, the Texas Department of Insurance, Division of Workers’ Compensation’s Research and Evaluation Group worked with The Public Policy Research Institute at Texas A&M University to interview 1,619 year-round private-sector Texas employers.

Published: April 2023 by the Workers' Compensation Research & Evaluation Group.

Key findings

Figure 1 shows that the percentage of Texas private-sector employers that are workers’ compensation subscribers and the percentage of employees who work for a subscriber both increased in 2022. The employer subscription rate increased three percentage points to 75% in 2022 and the percentage of employees working for subscribers (83%) was the highest in 12 years.

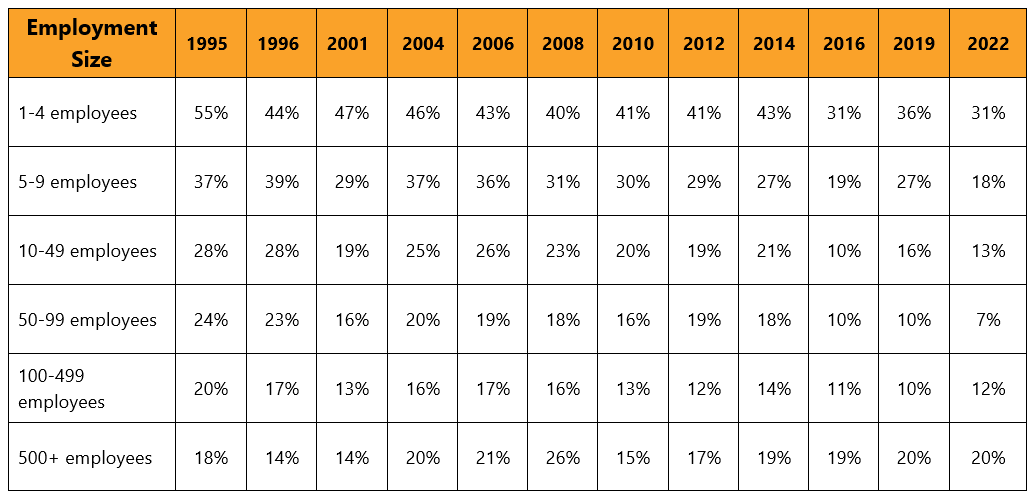

Rates of non-subscription among most employers continues to trend downward. The only category with an increase in non-subscribers was employers with 100-499 employees. Small employers, those with 1-4 employees, had the highest percentage of non-subscribers at 31% in 2022 (Table 1). Employers with 50-99 employees had the lowest percentage of non-subscribers at 7%.

Table 1. Percentage of Texas Private-Sector Employers That Are Non-Subscribers by Employment Size

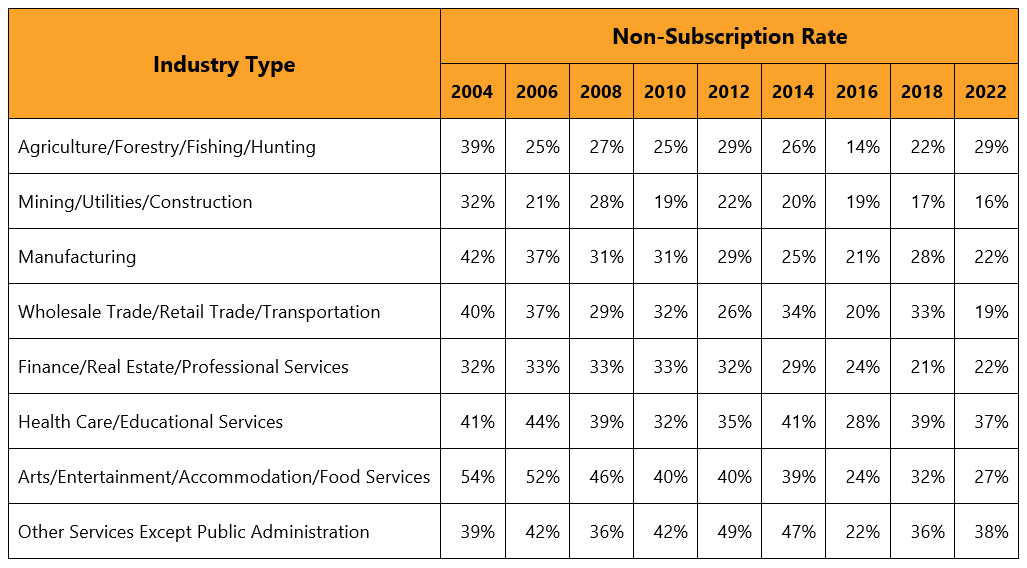

Most industry groups saw a downward trend in non-subscriber rates. Mining/Utilities/Construction continued to have one of the lowest non-subscription rates among all industries, at 16% in 2022. When comparing 2018 to 2022, Wholesale Trade/Retail Trade/Transportation had the largest reduction in the percentage of non-subscribers from 33% to 19%. Agriculture/Forestry/Fishing/Hunting had the largest increase in non-subscriber rates, from 22% in 2018 to 29% in 2022.

Table 2. Percentage of Texas Private-Sector Employers That Are Non-Subscribers by Industry

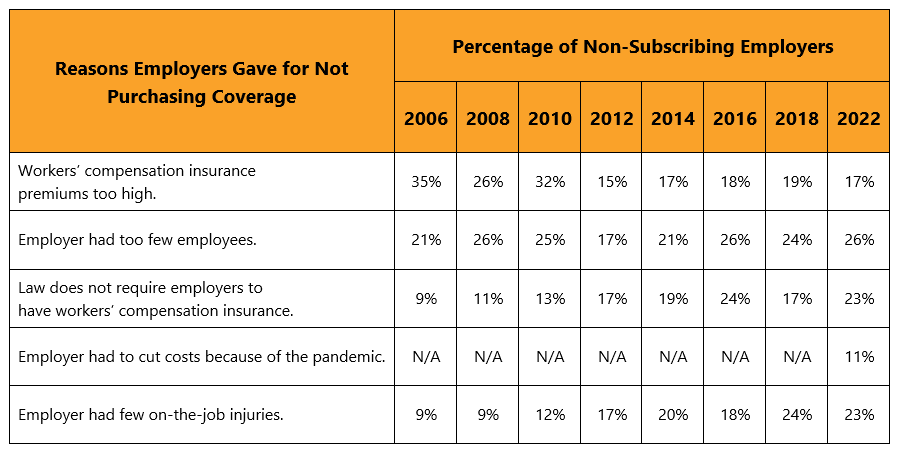

As Table 3 shows, the most frequent reason non-subscribers gave for not purchasing workers’ compensation coverage was that they had too few employees (26%). One of the least frequent reasons that they gave for not purchasing coverage was that premiums were too high.

Table 3. Most Frequent Reasons Non-Subscribers Gave for Not Purchasing Workers’ Compensation Coverage

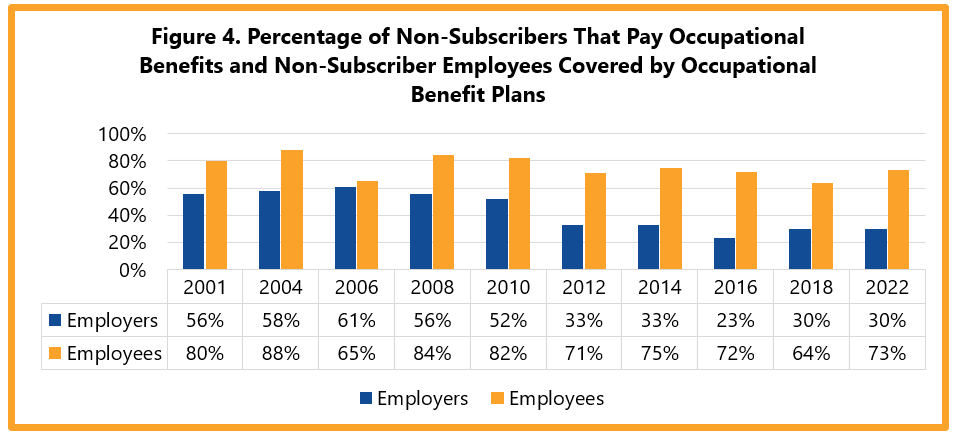

Thirty percent of non-subscribers reported that they have alternative occupational benefits plans for their employees, a percentage that has been fairly stable since 2012. The percentage of non-subscriber employees covered by occupational benefit plans increased to 73% in 2022 from 64% in 2018.