Key findings

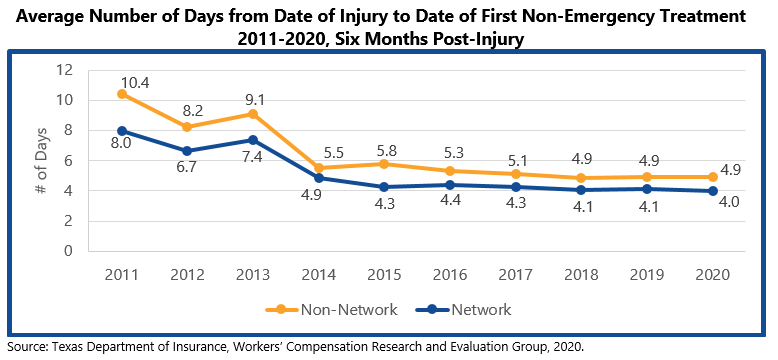

Today on average, injured employees are waiting half as long to get their first non-emergency medical visit as they did in 2011.

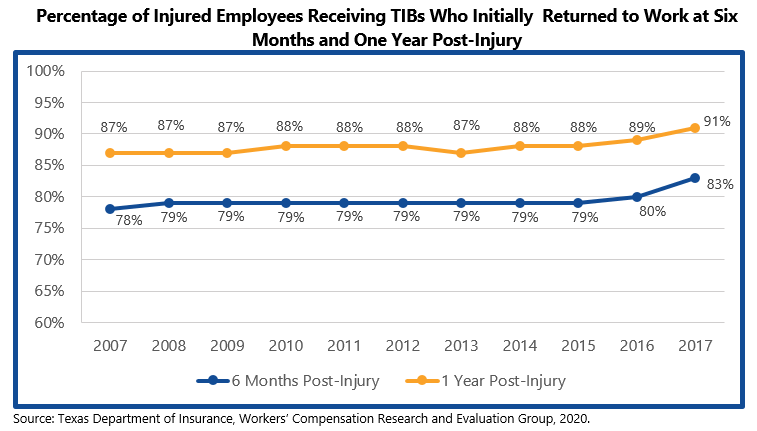

A higher percentage of injured employees receiving income benefits went back to work within six months in 2017 (83 percent), compared to those in 2007 (78 percent).

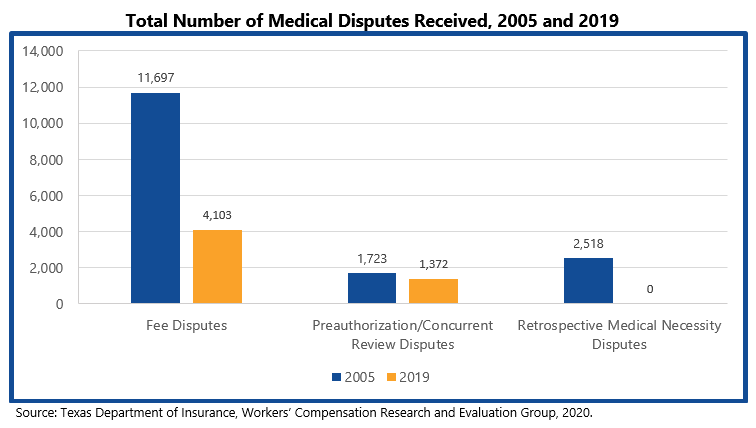

Since 2005, medical fee disputes decreased about 65 percent, preauthorization and concurrent review disputes decreased about 20 percent, and retrospective medical necessity disputes have essentially disappeared in the system.