April 11, 2024

Unexpected indoor waterfall? Home or renters insurance might help.

A pipe bursts—or a toilet overflows or a washer hose breaks.

Good news: Your home or renters insurance policy covers sudden and accidental water damage. Your personal belongings are covered too.

Also, if mold develops on a damaged item, it would be covered.

Still, policies usually won’t cover damage from gradual leaks or seepage—and that includes damage from mold.

Mold from a flood wouldn’t be covered because home policies don’t cover floods. You would need a separate flood policy.

If you have a sudden leak, shut your water off at the main. Move expensive items off the floor. Your insurer may deny your claim if you don’t protect your property.

One more tip: You can always check what’s covered by reading your policy or calling your agent.

Listen to this Texas Insurance Podcast to hear expert advice on insurance and water damage.

Learn more

- When are water damage and mold covered by insurance?

- Does insurance cover water damage caused by burst pipes?

- Winter storms: Tips for preparing your house and pipes

March 14, 2024

Any place can flood. Do you have flood insurance?

It can rain and flood anywhere. Your homeowner or renter’s policy doesn’t cover flood damage. You might want to buy flood insurance.

One inch of water in a home or apartment can cause up to $26,000 in damage.

To shop for coverage, talk to your insurance provider. If they don’t offer a flood policy, go online to floodsmart.gov to find providers.

A flood policy takes effect 30 days after purchase. It’s wise to shop before hurricane season, which begins June 1.

Get expert advice on flood insurance in this Texas Insurance Podcast.

Learn more

- Flood insurance: Why you need a policy

- You live in a flood plain

- Hurricane season: How to prepare your home and property

March 4, 2024

Do you need insurance experience to work for TDI? No.

True or false? You must have an insurance background to work for the Texas Department of Insurance.

False!

TDI has wide-ranging job opportunities. Recent job openings include those for attorney, investigator, actuary, auditor, programming, and accounting positions.

Sign up to get emails of TDI job postings

Isela Mata of TDI’s Human Resources office talks about why Texans of all stripes should consider working for the department in our video, A variety of job opportunities available.

Learn more

Thinking about a new job? Don’t forget the insurance.

February 8, 2024

How to file your insurance claim

Need to make an auto or home insurance claim?

Tips to help you succeed:

- After a car accident or incident at your home, talk to your insurance company. You’ll want to discuss your options. Maybe you don’t want to file a claim. Consider your deductible—how much you pay before your insurance pays.

- If you make a claim, write down details including when you called the company, who you talked to, and your adjuster’s name. Also, make a list of documents or information the company wants from you.

- After a car accident, move your car to a safe location. Take photos of the accident scene, including your car, other involved cars, and anything that’s been hit such as trees, buildings, or street signs. Also photograph the other driver’s insurance information, driver’s license, and license plate.

- If your house is damaged, write down the time and date you first saw the damage. Also note what the weather was like at the time. Take photos of any damage. Protect your home from further damage by covering broken windows or putting a tarp over a roof hole. Don’t make permanent repairs until your company gives the OK.

- On any claim, save all receipts.

.

Want more tips about making a claim? Listen to this Texas Insurance Podcast.

Learn more

- Tips for filing a claim with your insurance company

- Were you in a wreck? Tips for auto insurance claims

- Steps to getting your home or car insurance claim paid

September 7, 2023

How to shop for home insurance

Are you wanting to lower your home insurance costs?

Consider shopping for a new policy. Plan ahead by starting a month or more before your current policy expires.

Shopping tips:

- Ask your agent if a premium increase or other changes in your policy are in the works. This helps you make comparisons.

- Visit HelpInsure.com to get estimated premium quotes from different companies.

- Consider a higher deductible, which could reduce your premium.

You can hear more on shopping for home insurance in the Texas Insurance Podcast.

Learn more

- Ways to save money on home insurance

- Lower your home insurance cost by asking for discounts

- How to shop smart for home insurance

- FAQ: Homeowners insurance, claims, saving money, and more

August 3, 2023

Coastal Texans can turn to TWIA for hail, windstorm coverage

In August 1970, Hurricane Celia slammed ashore at Corpus Christi, killing and injuring residents and leaving previously unheard-of hundreds of millions of dollars in damage.

In response to insurance companies increasing rates or no longer selling wind and hail coverage along the Gulf Coast, state lawmakers in 1971 launched the Texas Windstorm Insurance Association (TWIA).

TWIA continues to serve as the wind and hail insurer of last resort for property owners in Texas’ 14 coastal counties and parts of Harris County. TWIA currently backs more than 237,000 policies.

If you live in a coastal community, read your homeowners policy to see if it covers hail and wind damage. If not, contact your insurance agent to see what options you have for coverage.

Eric Casas, TWIA ombudsman at the Texas Department of Insurance, cautions against assuming you can go without wind or hail coverage just because your home hasn’t been hit by a terrible storm. And if you have a mortgage, your lender will likely require you to have windstorm coverage.

Hear more tips about protecting your home from hail and wind damage in this episode of the Texas Insurance Podcast.

Learn more

- What is windstorm insurance?

- Texas Windstorm Insurance Association

- Homeowners, flood, and wind and hail policies: Know how they work

- What you need to know about windstorm inspections

July 18, 2023

Biking and insurance pedal together

When you ride your bike, insurance rides with you. For instance, if your bike is stolen, your homeowners or renters policy might cover replacement, though your coverage might have a dollar limit.

Read your policy or contact your agent to be sure.

If you bike often, you may want to ask your agent about liability coverage. If you cause an accident that results in property damage or injures someone, liability insurance could help cover costs you’re responsible for. If you have home or renters insurance, it likely includes liability coverage.

July 6, 2023

Have an insurance complaint? Tips to understand the complaint process

Have a problem with your insurance company, agent, or adjuster?

You might want to file a complaint with the Texas Department of Insurance (TDI).

Before you consider a complaint, talk to your insurance agent or company about the problem you’re having. Sometimes conversations clear the air, delivering satisfaction.

You can file a complaint with TDI about insurance companies, agents, and adjusters. We can help you get started.

After you file a complaint, our experts will reach out to the insurance company to get more information. Last year, we returned $56 million to consumers in refunds and claim payments.

Before you file a complaint, understand that there are some things we can’t do:

- We can’t make a company pay a claim unless the failure to pay violates a law or the terms of your policy.

- We can’t help with complaints against another person’s insurance company. For instance, we probably won’t be able to help you if you’re in an accident and the other driver’s insurance company won’t accept liability.

- We can’t decide who was at fault in an accident.

Questions? Call our Help Line at 800-252-3439 to understand your rights. For more on filing a complaint, watch this Texas Insurance podcast.

View podcast Q&A: How to get help with an insurance complaint

Learn more

- Can TDI help with my complaint? (video)

- What if my insurance isn't paying enough?

- Not sure who to call with your question or complaint? We can help.

- Get help with an insurance complaint (video)

June 1, 2023

How to safely set up and run your portable generator

If you own a portable generator, remember to place it outdoors at least 20 feet from your home’s doors, windows, or vents.

Keeping a distance helps protect you from carbon monoxide gas, which is colorless, odorless, and potentially deadly.

More generator safety tips:

- Don’t put fuel in a hot generator. Turn it off and let it cool before refueling. Only put fuel in containers made for fuel. Never store fuel inside your home.

- Take care of cords. Plug appliances into your generator directly or use a heavy-duty, outdoor-rated extension cord. Check the cord for cuts, tears, or missing prongs.

- If you want to connect your generator to your house’s wiring, have a qualified electrician do it. Make sure the electrician uses a properly rated switch that meets electrical codes.

Watch our video for help using portable generators from Kelley Stalder, chief engineer of the Texas State Fire Marshal’s Office.

View podcast Q&A: How to safely use a portable generator

Learn more

- Using a generator? Stay safe from carbon monoxide

- Tips to protect your family from carbon monoxide poisoning (video)

- Carbon monoxide detectors save lives (video)

May 2, 2023

Plan to be safe before a hurricane hits Texas

The Texas Division of Emergency Management (TDEM) regularly leads the state’s response to natural disasters including summer storms and hurricanes.

It also wants Texans to plan ahead to stay safe.

For instance, it’s a good idea to keep emergency “go-kits”— basic disaster supplies including food, water, medicine, clothes, and other vital items — in your home, office, and car.

Also wise: Settle with family members ahead of time where you’re going to go if a bad storm hits. And if you think you might need flood insurance, shop before you hear a scary weather forecast. It takes 30 days for a flood policy to take effect.

View podcast Q&A: How to prepare for hurricane season

Learn more

- Hurricane season: How to prepare your home and property

- Flood insurance: Why you need a policy

- Before the storm

- Texas Ready disaster supply checklist

April 6, 2023

Prepare your home and family for spring Texas storms

A spring hurricane is unlikely. The latest one, Hurricane Alma, fizzled out near Cuba in May 1970.

Still, spring rains, hail, wind and even tornadoes can threaten homes, cars, and lives.

Some storm preparation tips:

- Paul Yura of the National Weather Service suggests you keep three days of food, water and other supplies, including pet food, on hand.

- Also, Yura says, decide well ahead of time where your family will go if dangerous weather approaches.

- Count on weather alerts on your cell phone. But, Yura says, also keep a weather radio handy, with fresh batteries. Sometimes the phone runs out of juice.

View podcast Q&A: How to prepare for spring storms

Learn more

- Texas summer storm safety

- 5 tips for driving in windy conditions

- Are you ready for a disaster?

- Tips to avoid a tornado: Follow weather reports

October 13, 2022

Fire in your house? Get out fast.

If a fire breaks out in your home, you might have just minutes to escape.

So get out.

Leave.

Don’t hesitate.

Use these tips to plan how you’ll get your family and pets out safely:

- Make a home escape plan and practice it with everyone in your home. Have someone watch the drill and time it. Practice the plan until it’s automatic for everyone.

- Practice your escape plan twice a year. Try one practice at night, one in daylight.

- Practice finding more than one way out.

- Know at least two ways out of every room, if possible. Make sure exit doors and windows open easily.

- Agree on an outdoor meeting place—a tree, mailbox, light pole. Make sure everyone knows to go there.

- Teach your children how to escape without your help. Tell them not to hide under a bed, in a closet, or in a bathroom.

- Never go back inside a burning building. Get out and stay out!

Learn more

September 15, 2022

Back to campus? Take these easy steps to stay safe from fire.

September and October are the peak months for fires in student-occupied property—especially between 5 and 9 p.m. Most of these fires are caused by cooking.

From 2015 to 2019, U.S. fire departments responded to an estimated annual average of 3,840 structure fires in dormitories, fraternities, sororities, and other related properties

Take a few easy steps to help stay safe:

- Make sure your bedroom and other living areas have working smoke alarms.

- Practice a fire escape plan. Find two ways out of your room, apartment, or home.

- Don’t cook when you’re distracted. It could lead to a mistake and fire.

- Use only flameless candles.

- Keep clear all exits, hallways, and stairwells.

- Clean the dryer lint trap before and after each use. Clogged vents are a fire hazard.

- Make sure you, and your roommates, know your dorm or housing’s safe meeting place if you have to escape.

- Leave quickly if an alarm sounds. Even a short delay could be dangerous. Leave everything and get out.

Learn more

How college students can stay healthy, safe, and protect their stuff

July 28, 2022

Thinking about buying a residential service contract? It’s not home insurance.

When you’re buying a home, you also might be asked if you want a residential service contract. They’re sometimes called a home warranty.

These service contracts are different than home insurance. Insurance pays for damages from events your policy covers like fire or theft.

A residential service contract covers certain items in your home when they break down from normal wear and tear. (Home insurance doesn’t pay for wear and tear.) Depending on your contract, you may get coverage for appliances, such as stoves and refrigerators, to water heaters, electrical and plumbing systems, and even swimming pools.

Residential service contracts can bring peace of mind about the machines and systems that keep your home comfortable. Not all service contracts are the same, though. Remember to carefully read the contract before signing up.

Under Texas law, companies that sell residential service contracts must be licensed by the state.

In our latest video, we spoke with Elizabeth Salinas-Strittmatter with the Texas Department of Licensing and Regulation (TDLR) about how residential service contracts work.

Learn more

- List of TDLR-licensed residential service companies

- Five things your home policy won’t cover

- Do you have enough home insurance?

July 14, 2022

Spacecraft hit your home? Insurance covers that and more.

You may have heard; NASA plans a year-long study of reported UFOs.

But did you know home insurance would pay if a spacecraft hit your house?

Really.

In the unlikely event a spacecraft damages your home, most home policies would pay for damages. Falling objects is a “covered peril.”

Here’s what else your home policy probably covers—and doesn’t:

- Damages from hail or fire are covered.

- Tornado and inland hurricane damages are covered. If you live near the Gulf Coast, you’ll likely need a separate windstorm policy.

- Most policies cover water damage from leaks and broken pipes, but there are exceptions. Read your policy to see what’s covered.

- Most policies do not cover damage from water that comes from outside your home. You’ll need a separate flood policy.

- Damages from earthquakes are not covered. Neither are termites, wear and tear, and sewer backups.

Learn more

- Home insurance policies: All risk or named peril

- Tips to help you shop for homeowners insurance

- Does insurance cover water damage caused by burst pipes?

- Homeowners insurance guide

- New home? How to shop for insurance (podcast)

June 16, 2022

Tips to avoid a tornado: Follow weather reports

You’re driving home from work, inching along in highway traffic. Then you hear a tornado warning on the radio. Or worse, you see a tornado twisting your way.

Don’t get yourself into that situation!

A National Weather Service expert urges everyone to follow the weather, especially during the spring and summer tornado and hurricane seasons.

If your city or county is under a tornado watch, plan to be inside a building—and not sitting in your car or truck.

Watch “How to stay safe in a tornado” for more tips from the National Weather Service about protecting your family and property from a big storm.

Read our blog post, “Danger, danger! Don’t mix up tornado watches and warnings.”

See our tips: “Are you prepared for a tornado? Here’s how to protect your home.”

May 19, 2022

Title insurance isn’t required by law. But it protects you.

Having a property title means you own the property and can sell, rent, or transfer ownership of the property. Title insurance protects you against problems with getting a title when you buy property.

Title insurance companies search for problems with a title that need to be corrected before it’s given to you. Possible problems could be:

- Unpaid property taxes.

- Fraud or forgery of a previous deed (the legal document used to transfer the title).

- A spouse or unknown heir who could make a claim against the property.

If there’s a challenge to your ownership later, your title company will handle the dispute.

If you’re borrowing money to buy a property, your lender will require you to buy a Loan Policy of Title Insurance (PDF) to protect their interest.

Otherwise, you can get peace of mind from an owner’s title insurance policy, which lasts for as long as you or your heirs own the property.

TDI sets premium amounts for title insurance policies sold in Texas, so the rates are the same for all title companies. It still might be worth researching title companies. You should make sure the title company is licensed and has good customer reviews. You also might want to check their closing costs, which can vary.

Watch “How does title insurance work?” featuring TDI’s David Muckerheide talking about title insurance.

Learn more

March 31, 2022

Staying safe when lightning strikes

In any given year, your odds of getting struck by lightning are one in 1.5 million. Doesn’t sound too bad, right? But across your lifetime, the odds don’t look that great – they go to one in 1,800. Of course, the odds of you getting hit go higher if you ignore the dangers of thunderstorms.

Heed these tips and avoid zaps from the sky:

- If you’re outdoors and you see lightning or hear thunder, enter a sturdy building or get inside a car and close the windows.

- Stay away from utility poles and metal fences. And get out of cars with soft tops, tractors, and motorcycles.

- Don’t lie flat on the ground or in a ditch. Run to the nearest building or car. If your hair stands on end, squat down, and put your head between your knees.

- If you’re indoors, stay away from windows, plugged-in appliances, computers, and power tools. And don’t take a shower or bath, wash dishes, or stand near plumbing; water pipes conduct electricity.

There are also ways to protect your house from lightning.

Homeowners can invest in a lightning protection system, which has three parts:

- Lightning rod: Intercepts the lightning.

- Down conductor: Takes energy from the lightning down the side of the building.

- Ground terminals or grounding rods: Takes the energy from the down conductor and puts it deep into the ground.

If you want to install a lightning protection system, hire a professional certified by the Lightning Protection Institute.

In our latest This Is TDI video, John Jensenius of the National Lightning Safety Council talks about:

- Common outdoor activities that put people at risk of being struck by lightning.

- The odds of getting struck.

- How to protect your home.

Learn more

- Thunderstorms: How to protect yourself from lightning

- 5 Tips for lightning safety

- Texas town listed as the US lightning strike capital

February 10, 2022

Older Texans face greater fire risks. Learn how to make a safe exit.

Older adults have a higher risk of dying in a house fire. But taking precautions can save lives.

Some tips to prevent fires and to make a safe exit:

- Install smoke alarms on every level of your home, inside and outside the bedrooms. The best alarm system is interconnected so that when an alarm sounds in one room, alarms in the other rooms also go off.

- Keep your glasses, cane, wheelchair, or other helping devices close in case you need to leave your home quickly.

- Test your alarms monthly.

- Replace alarm units every 10 years.

Make and practice a home escape plan with everyone in your house. In a fire, you might have just two minutes to get out.

Watch our latest “This Is TDI” video featuring Teresa Neal of the U.S. Fire Administration who shares fire safety tips, including cooking safety tips for older adults.

Learn more

- Smoke alarms: Where to put them, how often to replace batteries

- How to protect your family from a home fire

- How to escape from a house fire

- How to prevent kitchen fires with our cooking safety tips

January 27, 2022

You could save money by comparing car insurance prices

People routinely price-shop food, clothes, tech products and other items. Yet in 2020, more than half of U.S. customers didn’t take any action to manage their auto insurance costs, according to a J.D. Power study released in 2021.

Customers who did act mostly chose to reduce coverage; increase their deductible; or shop or shift to a different provider, the study found.

Michele Thomas of TDI’s Property and Casualty Division suggests that car owners check coverage prices every two years or so—especially if you haven't had any tickets or accidents in some time.

Your price check should start with your current carrier. It might have discounts reducing your costs.

Watch our video, How to save on car insurance.

Learn more

- Ask for discounts to lower your auto insurance premium

- How you drive could save you money on car insurance

- Shopping for auto insurance: What to know before you buy a policy

- Answers to your auto insurance questions (podcast)

December 16, 2021

Avoid frozen pipes and costly water damage by taking steps now

Last winter’s big freeze left many Texans with frozen pipes.

But by taking simple steps now, you could head off thousands of dollars of water damage to your walls, ceilings, carpets, and furniture.

Key tips

- Install inexpensive wraps on exposed pipes. Start in the attic, where many Texas homeowners saw pipes freeze last winter.

- Wrap your outdoor faucets.

- Whether you own your home or live in an apartment or condo, identify water shutoff valves indoors and out. This will ready you for cutting off the water if a freeze poses risks.

- Don’t delay preparations until a freeze looms. Act now to ease your worries.

In this TDI video, How to prevent pipes from freezing, an expert with the Texas State Board of Plumbing Examiners shows several preventive steps you can take (plus, he spots a toad).

Learn more

- When are water damage and mold covered by insurance?

- Is water damage covered by home insurance? (video)

December 9, 2021

How can I find the best health care insurance for my needs?

When shopping for health insurance, there’s a lot to consider. In this video, we share tips for how to shop smart:

- Be aware of the deadlines to enroll if you’re shopping for health insurance through HealthCare.gov:

- You have until December 15 to get coverage on January 1.

- You have until January 15 to get coverage on February 1.

- If you have a medical issue or a doctor you like seeing, make sure that plan covers treatment, and your provider is in the plan’s network. If you take a medication, make sure it is covered. Call the insurance company if you have questions about what’s covered.

- Review out-of-pocket costs including deductibles and co-pays, which can increase depending on the cost of the plan.

- If costs have you worried, find out if you can get a tax credit. “Premium tax credits” or subsidies are based on your income. More people are expected to get subsidies than in past enrollment periods.

Use our checklist to help you decide on health coverage. Health plan shopping guide.

Make sure you weigh your options when it comes to health care insurance coverage. The Health care coverage guide has answers about how coverage works or if you need help understanding your rights.

Texas Health Compare allows you to find and compare health insurance plans. If you have more questions, call the TDI Help Line at 800-252-3439.

November 18, 2021

Does insurance cover water damage caused by burst pipes?

When Winter Storm Uri covered Texas in ice and snow in February 2021, it caused more than $8 billion in insured losses. Texans filed more than 450,000 insurance claims after the storm. A lot of that damage was caused by water from broken pipes.

In our latest video, we asked our Property and Casualty Division what Texans need to know about insurance coverage for water damage.

- Most homeowners policies cover water damage from leaks and broken pipes, but there are exceptions. Always read your policy to see what’s covered.

- If you rent, the owner’s policy won’t cover your furniture, electronics, clothing, or other personal items. Consider buying renters insurance to cover your things.

- If you have a leak, turn the water off at the main and move expensive items off the floor. Your insurer may deny your claim if you don’t protect your property.

- Home and renter’s insurance only cover leaks that happen inside your home. They don’t cover flood damage. You need a separate policy to cover flooding. Visit floodsmart.gov for more information.

For tips about damages caused by issues like burst pipes, see When are Water Damage and Mold Covered by Insurance?

There are also steps you can take to protect you home and property from winter damage.

October 28, 2021

Does insurance cover treatment for mental health and substance use disorders?

If you’re dealing with stress, depression, anxiety, or substance abuse issues, your insurance should help cover your treatment—just like it would with a medical issue.

In our latest video, we asked Cindy Wright in TDI’s Customer Operations what Texans should know about insurance coverage for mental health and substance use disorders.

- Most health insurance plans cover services for mental health and substance use disorders. If you aren’t sure, check your policy or contact your insurance company.

- The law guarantees “parity” for most health plans, which means health plans must cover mental health and substance abuse treatment the same as medical health. Learn more on our How to get help with a mental health issue

- If your mental health insurance claim is denied, you may be able to file an appeal with your insurance company or ask for an external review.

- Texas Health and Human Services has resources to help you get access to mental health and substance use treatment through your insurance plan.

If you have questions about appealing an insurance claim or the claims process, call the TDI Help Line at 800-252-3439.

For more information, see our webpage, Insurance coverage and parity for mental health and substance use disorder services.

October 14, 2021

Protect your information from scams during Medicare open enrollment

Did you get a phone call from someone offering a free COVID-19 vaccine or a gift if you give them your Medicare information? It’s probably a scam. A health plan will never call you out of the blue and ask for personal information.

Medicare open enrollment—the time of year you can sign up for or make changes to a Medicare plan—is from October 15 to December 7. Which also makes it prime time for scammers.

Never give your Medicare information to someone you didn’t expect to get a call from. If you aren’t sure, call 800-252-9240 to find your Area Agency on Aging, or check with your local State Health Insurance Assistance Program.

About 4 million Texans have health insurance coverage through Medicare. In our new video, we talked to Yvette McVeigh with the Area Agency on Aging. McVeigh explains what to do when your plan doesn’t cover the medications you need or let you see the specialist who’s right for you. She also had great advice for avoiding scams.

October 7, 2021

Is your smoke or carbon monoxide alarm chirping? Here’s what it’s telling you.

Just about everyone has woken up to the sounds of a smoke or carbon monoxide alarm going off in the middle of the night. But what do those chirps and beeps mean? In our latest video, we asked the National Fire Protection Association what the noises mean and how to stay safe from fires and carbon monoxide. Here’s a simple guide:

- Smoke alarms alert you with three beeps in a row.

- Carbon monoxide alarms alert you with four beeps.

- A single chirp means the battery is low or the detector should be replaced.

Some newer alarms also have a voice that gives you directions. Other alarms, made for people who are deaf or hard of hearing, shake your pillow or have a strobe light.

- Every alarm has a manufacture date or an expiration date. Replace your alarms before the expiration date, or within 10 years of the manufacture date.

- Test your alarms once a month.

- Replace the batteries once a year.

- Replace the alarms at least every 10 years.

When you buy new alarms, put them inside and outside each sleeping area. Not just bedrooms, but anywhere people sleep. If your garage is attached to your home, you need one there too.

Have a family escape plan and pick a safe place to meet outside. Then practice your plan so everyone’s ready when an alarm goes off. If someone in the house has mobility issues, make sure they sleep on the ground floor. It could be a matter of life and death.

Learn more

- Fire in your house? Get out fast

- How to avoid carbon monoxide poisoning at home

- How to protect your family from a home fire

August 26, 2021

Apartment hunting? Look for these safety features

Heading off to college? Starting your career in a new town? If you’re getting a new place for the first time, check out our new video for fire safety tips from the Texas State Fire Marshal.

Look for sprinkler systems and fire alarms. The best systems have voices, not beeping, because people wake up faster to a voice than a noise. And always check the evacuation plan.

The most common causes of apartment fires can all be avoided—here’s how:

- Don’t cook when you’re tired—or leave a cooking fire unattended.

- Don’t overload power outlets with chargers and electronics.

- Avoid candles, or at least keep combustibles away from them. Better yet, get artificial candles that flicker like a flame.

- Don’t put anything within three feet of a space heater.

- If you have a clothes dryer, clean the lint out of the vent.

Make sure your new place has smoke and carbon monoxide detectors. Check the manufacturing date on the back of each one. Have your landlord replace any that are 10 years old.

Think about fire safety when you go out, too. Look for alternative exits at football games, concerts, clubs, stores, and restaurants. In an emergency, most people crowd the front door, so make sure you know other ways out. If any place gets too crowded, leave.

And remember, your landlord’s insurance only covers the building. You need renters insurance to cover your things inside it. For more information, visit tdi.texas.gov or call 800-252-3439.

We’ve also got tips on how to avoid carbon monoxide poisoning at home.

August 19, 2021

Could a travel insurance policy pay off on your next trip?

Air travel is hitting pandemic highs—a record 2.2 million people went through airport checkpoints during the first Sunday in August, according to the U.S. Transportation Security Administration.

Still, there’s a lot of uncertainty to travel these days. So for our new video, we talked to the U.S. Travel Insurance Association about protecting your travel plans.

You can buy travel insurance that covers things you already paid for, such as flights, cruise tickets, or hotel deposits. You can also buy a “cancel for any reason” policy, which pays back about 50 to 70% of the cost of your trip if you if you cancel for any reason—or even no reason.

How do you know if you need travel insurance? Well, think about what you’d have to pay if you had to cut your trip short. Could you afford another ticket? What if you had to book an extra night in a hotel? Or if you had to be evacuated for medical reasons? If you can’t cover those costs, consider buying travel insurance.

Travel insurance typically costs between 5 and 10% of the cost of your trip. Adding “cancel for any reason” coverage will cost 40 to 70% more. And while most policies don’t cover the COVID pandemic itself, they may cover things like a quarantine, sickness, job loss, bad weather, or a government-mandated airport shutdown.

Read our tips: Travel insurance: What does it cover and when do you need it?

July 29, 2021

Home insurance isn’t required. But it makes sense.

No law requires you to have home insurance. But having a policy can protect your investment, giving you peace of mind.

If you have a mortgage, your lender probably requires home insurance.

A new study by the Texas Real Estate Research Center estimates that 4.1% of Texas homeowner households with a mortgage don’t have home insurance. In contrast, 26% of Texas residents who own their homes free and clear of debt lack home insurance—with rural homeowners generally more likely to lack coverage, the study says.

A home policy can help even if your home is paid off. It shields you from facing potentially massive out-of-pocket costs to repair or rebuild if a burst pipe, fire, or other incident wreaks damage.

Questions to ask your agent or insurance company

- What kinds of damages does the home policy cover?

- Does the policy fully cover replacing my house and possessions?

- What’s the premium, what I pay for the policy up front?

- What’s my deductible, what I must pay before the insurance pays anything?

- Do I need additional coverage such as a flood policy?

See more in our new video on common questions about home insurance.

Ready to shop? Find and compare Texas home insurance policies or use TDI’s home insurance guide.

July 8, 2021

Do construction costs affect my home insurance?

The cost of lumber tripled in the past year. We talked to the executive director of the Insurance Council of Texas about how construction costs factor into what you pay for homeowners insurance.

Insurance covers the cost to rebuild your home after a disaster. As construction costs increase, it’s important to adjust your policy limits. While you might be tempted to save money by getting less coverage when you renew your policy, that could mean higher out-of-pocket costs for you if your home is damaged or destroyed.

To look for the best deal on insurance, shop around with HelpInsure.com. Texas has more than 160 homeowners insurance companies, so smart shoppers will take advantage of the competition. And check out discounts for bundling or smart home technology.

Watch this video to see what construction costs mean for your homeowners insurance and for tips to keep your insurance costs down.

June 17, 2021

Average cost of renters policy? $15 a month

If you rent an apartment or house, it’s a good idea to have renters insurance. It pays to replace your personal belongings if they’re stolen or damaged by a fire, storm, or burst pipe.

We talked to a Houston-area real estate agent about the importance of having renters insurance.

Christy Rodriguez says renters should weigh the cost of renters insurance (about $15 a month) to the cost of relocating and replacing their belongings if their rental is damaged.

Renters insurance also pay for a hotel and food if you need to move out while your rental is being repaired. It also pays if someone is hurt in your home, and we all have that one friend…

Learn more about renters insurance.

June 10, 2021

You live in a floodplain

Your home lender may only require flood insurance if you live in an area at high risk of flooding, but we all live in a floodplain. We talked to a FEMA expert about how flood insurance works and why you may need it.

Check FEMA’s Flood Map Service Center to see if you live in or near a flood hazard area. But as the FEMA expert explained, even those living outside high risk areas may flood. He said as many as 65% of disaster assistance claims for flood damage have come from people living outside areas designated as flood hazard areas.

He also explained the limits of disaster assistance. It’s not a substitute for flood insurance. First, you can only get disaster assistance after a disaster declaration. And disaster assistance is designed to help you get back on your feet – to make your home livable – but not to rebuild it as it was before. For that, you need flood insurance.

Just one inch of water can cause $26,000 of damage to a home. To make sure you’re protected, ask your insurance agent or company about flood insurance.

To learn more, go to FloodSmart.gov or review these tips.

June 2, 2021

Starting your financial future together

Getting married soon? You’re not the only happy couple! Wedding planners report being booked through the year as couples reschedule weddings postponed due to the pandemic. We can’t help you find a caterer, but we do have an insurance checklist to get you off to a good financial start.

Renters insurance: The average renters policy in Texas costs about $20 a month. That’s a great way to protect those nice wedding gifts. It will pay to replace items damaged by a burst pipe or other cause. It will also cover personal items stolen from your home or car.

Auto policies: Combining your auto policies may save you money. Most insurance companies offer a discount if you have more than one vehicle, and rates are usually lower if you’re married.

Health coverage: You have several options for health coverage. If both of you have coverage through work, compare the policies. One may have better benefits, a lower deductible, or a lower cost to add a dependent. And check to see if there’s a deadline to add a spouse.

Life insurance: As your situation changes and your family grows, you may need life insurance. Consider how much income would need to be replaced to help with childcare, your mortgage, and other debts.

May 26, 2021

Carbon monoxide – the silent killer after the storm

Hurricane Laura, a powerful Category 4 storm, left a path of destruction across Louisiana last year and caused 15 deaths. Eight came after the storm, caused by carbon monoxide poisoning from portable generators.

Sheletta Brundidge’s relatives were among the victims. They rode out the hurricane but lost power after the storm. Five family members gathered in one home with a generator running in the garage. As they slept, the garage door blew shut. The home didn’t have a carbon monoxide detector to alert them to the deadly fumes filling the home. They never woke up.

Carbon monoxide kills more than 400 Americans each year and is responsible for 20,000 emergency room visits, according to the U.S. Centers for Disease Control and Prevention. We talked to Sheletta and an expert with our State Fire Marshal’s Office about the proper use of generators, the symptoms of carbon monoxide poisoning, and the importance of carbon monoxide detectors. Watch the interview and check out our tips to protect your family.

May 20, 2021

Start preparing now for 2021 hurricane season

Hurricane season in Texas means the potential for strong storms and flooding. The season starts on June 1, but you can start now to make sure your home and family are ready.

We talked to the Texas Department of Emergency Management to get some tips.

Gabriela Stermolle says we should put together a disaster kit with food, water, important documents, and pet supplies in case we need to leave the house fast.

We can also make our houses storm ready and think about flood insurance. But don’t wait too long: it takes 30 days for flood insurance to take effect.

Watch our interview for more tips to help you prepare for hurricane season.

Learn more about preparing and flood insurance: Before the storm.

May 13, 2021

A look at the 2021 hurricane season

Tropical storm Andres made news this week as the earliest named storm to ever develop in the Pacific Ocean. If it’s a year for surprises, what can we expect for the Atlantic hurricane season? We talked to the National Weather Service to find out.

Paul Yura said the 2021 forecast will probably be like recent years. He also explained that rip currents and improper generator use can lead to more deaths than storm winds.

Watch our interview for tips to prepare for the hurricane season, which begins June 1. For bonus science points, you’ll also learn about Atlantic Multidecadal Oscillation and how it affects hurricane activity!

For more tips, see Before the storm.

May 5, 2021

Used car prices are up, so shop smart

Cars are the latest shortage of the pandemic. A lack of computer chips is slowing production of new cars and trucks, and it’s increasing demand for used vehicles. It’s a great time to sell, but expect to pay more if you’re buying. Average trade-in values hit a record $17,080 in March, up 20% from a year ago, according to the car research website Edmunds.

While you may have to pay more, make sure you’re not getting scammed. Before you buy a used car, check the vehicle identification number (VIN). It will confirm the vehicle’s model year and let you know if it’s been reported stolen or salvaged.

The National Insurance Crime Bureau offers a free VIN check and has links to other services.

For more information about VINs and the information you can get with them, watch our interview with Tully Lehman, an expert at the National Insurance Crime Bureau.

April 29, 2021

Do you know your home’s wildfire risk?

In 2011, the most destructive wildfire in Texas history destroyed more than 1,600 homes in Bastrop County. A decade later, wildfires continue to pose a risk to much of Texas – and the risk increases as population expands into wilderness areas.

You can use the Texas Wildfire Risk Assessment Portal to check the wildfire risk for your home. Just enter your address, and you’ll get a look at the risk for your property and the surrounding area. Then listen to our interview with the Texas A&M Forest Service about what you can do to reduce those risks and protect your home.

For more tips, see Wildfire risks: Projects to help you protect your home.

April 15, 2021

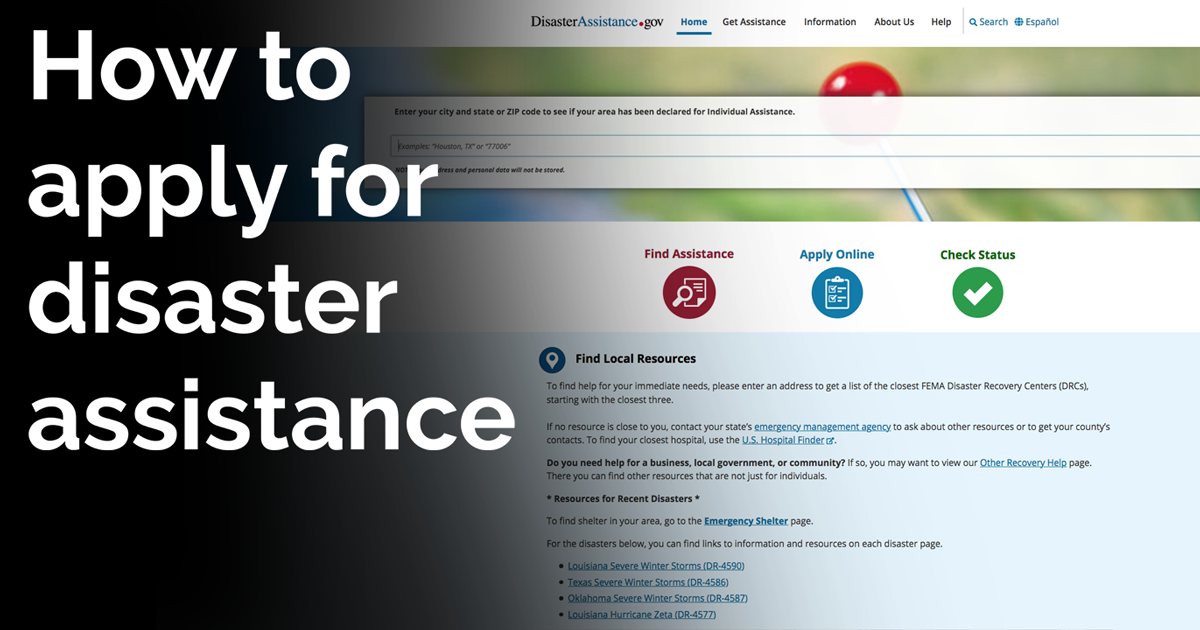

What FEMA covers and how to apply

Are you still dealing with repairs or extra expenses from the February winter storms? Homeowners and renters who have damage or other storm-related costs not covered by insurance can apply for federal disaster assistance. To learn more about what FEMA covers and how to apply, we talked to FEMA’s Kurt Pickering. (Update: The application deadline was extended to May 20 after we posted the interview.)

FEMA may cover expenses beyond repairs to your home. Help also may be available for temporary housing, to repair storm damage to your primary car, for extra child-care expenses, or to replace medications or medical supplies.

FEMA rental assistance may be available if you need to rent a different place while repairs are made to your rental home. Rental grants may be used for security deposits, rent, and utilities. FEMA can also help renters replace or repair damaged personal property, such as furniture, appliances, clothing, school supplies, and job-related equipment.

To apply, visit DisasterAssistance.gov or call 800-621-3362.

Insurance tips and help

How to get help or file a complaint: We can answer insurance questions, help with problems, and explain how to file a complaint against an insurance company or agent.

Videos: Our video library has short tips and interviews with experts on dozens of topics.

Insurance tips: Use our tips to get the best deal on insurance, protect yourself from fraud, and learn what to do when you have a problem.